United Healthcare has a big dental network and premiums that are customizable.

Best Dental Insurance plans for Seniors on Medicare: The majority of Medicare recipients require extra Medicare dental coverage. Cleanings, fillings, crowns, and dentures are not covered under original Medicare, which is divided into two parts: Part A (hospital insurance) and Part B (medical insurance). Certain dental expenses related to surgery or as part of an emergency may be covered. If you have Original Medicare and want dental insurance coverage, you can either purchase a separate dental insurance plan or enroll in a Medicare Advantage Plan (commonly known as Medicare Part C), which includes dental coverage.

Other benefits including dental coverage, vision coverage, and hearing coverage are included in the finest Medicare Advantage plans. Make sure that a Medicare Advantage plan with dental insurance coverage provides the dental benefits or dental services that are most important to you while shopping for one. Routine dental exams, X-rays, gum disease treatment, fillings, and dentures are all examples of this. You should look for dental plan that is widely available and have reasonable prices.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

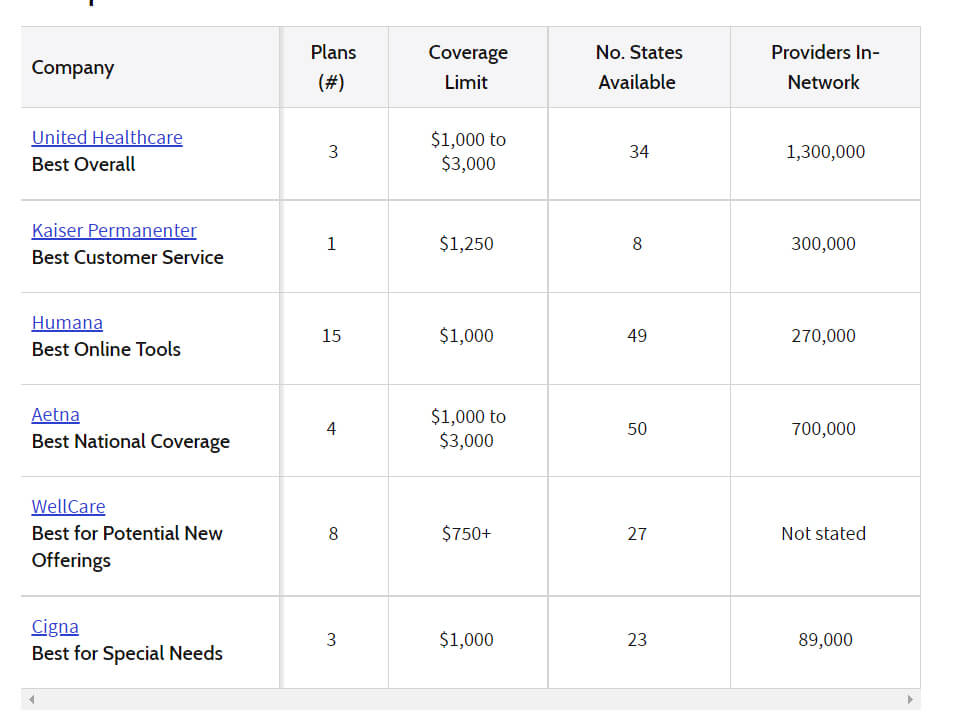

Best Medicare Dental Insurance Companies for Seniors in 2022

- Best Overall: United Healthcare

- Best Customer Service: Kaiser Permanente

- Best Online Tools: Humana

- Best National Coverage: Aetna

- Best for Potential New Offerings: WellCare

- Best for Special Needs: Cigna

BEST OVERALL

United Healthcare

Why We Chose It

For seniors on Medicare, United Healthcare is our top overall selection for dental insurance plans. They provide Medicare Advantage plans with a large network and a variety of premium options.

Pros & Cons

Pros

A vast network

Access to AARP benefits

Customer interface that is simple

- Dental discount plans

Cons

Depending on your region, there are just a few plan possibilities.

Medicare dental insurance coverage is not included in all Advantage plans.

Overview

United Healthcare, which was created in 1974 and is affiliated with the American Association of Retired People, was voted as the top overall provider (AARP). Medicare Advantage plans enrolled 22 million patients nationally in 2021. United Healthcare, which insures 27 percent of the 22 million individuals, has the largest proportion of them.

At least one United Healthcare plan is available to more than 74 percent of Medicare recipients.

In a J.D. Power research from 2021, United Healthcare was ranked fourth in overall customer service (795 points out of 1,000).

Premiums for their entire lineup of plans (HMO, HMO-POS, PPO, and so on) range from $0 to over $100 per month, depending on your needs and location. If you choose United Healthcare, you’ll have access to a variety of AARP programmes and services, including discounts on shopping and travel, home and auto insurance reductions, and free financial advice.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

BEST CUSTOMER SERVICE

Kaiser Permanente

Why We Chose It

Kaiser Permanente was chosen because of delivers great customer service. J.D. Power gives Kaiser the highest customer satisfaction rating.

Pros & Cons

Pros

High levels of consumer satisfaction

Any Kaiser Permanente facility can provide coverage.

Flexible premiums

Cons

Only eight states have it.

Dental insurance is an additional expenditure.

Dental coverage, hearing coverage, and vision coverage are all packed together.

Overview

Based on Medicare and J.D. Power, a data analytics and consumer intelligence firm, Kaiser wins our recommendation for top customer service. In J.D. Power’s Medicare Advantage satisfaction study, Kaiser placed in second place, barely one point behind the winner. Kaiser Permanente, founded in 1945, is the largest not-for-profit HMO in the United States, with 8.6 million members. Kaiser’s Medicare Advantage plan provides coverage at any Kaiser Permanente location, with monthly premiums ranging from $0 to over $100 depending on your needs.

Kaiser offers the Silver&Fit senior fitness program with many of their Medicare Advantage Plans. The program contains educational materials on healthy aging, social activities, and an activity and exercise tracking tool, and is available in both a facility-based and a home-based format.

Customers rated Kaiser the overall best Medicare Advantage plan for five years in a row (2015–2019) in J.D. Power’s annual survey, and Kaiser received an 843 in the 2021 J.D. Power Survey, the highest score of any Medicare Advantage plan. Additionally, in California, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, Washington D.C., and Washington, Kaiser Permanente 2022 Medicare dental plan got the highest Medicare Star Quality Ratings: 5 out of 5 stars.

BEST ONLINE TOOLS

Humana

Why We Chose It

For a dental insurance plan with sophisticated online tools, Humana is our top pick. They feature a smartphone app that allows customers to keep track of their meds, view claims, and even earn prizes for healthy behaviors.

Pros & Cons

Pros

A large number of useful web tools are available.

SilverSneakers is a workout program for seniors.

Except for Alaska, every state has it.

Cons

The user interface of a website might be perplexing.

Dental coverage is not included in all plans.

Overview

Humana provides a variety of online resources for Medicare Advantage Plan members. RXMentor from Humana assists subscribers in keeping a thorough and up-to-date list of their medications. Their MyHumana app allows users to access ID cards, medicine pricing, claims, and in-network providers using their fingerprints. You can earn, track, and redeem points for healthy actions with their Go365 program and app. Humana was chosen as one of the top online tools because of its beneficial website features.

SilverSneakers is a senior health and fitness programme that includes gym admission, classes, and the SilverSneakers Go fitness app for tracking and scheduling activities.

Humana provides supplemental dental coverage with several of its Medicare Advantage plans. For example, if you are located in Dallas, Texas, and enroll in the Humana Gold Choice PFFS plan, you have a $45 copay for in-network dentist visits and a $50 copay for an out-of-network dentist for Medicare-covered dental services. Humana’s MyOption Dental – High DEN838, which provides benefits for preventive, basic, and major dental procedures at both in-network and out-of-network dentists, is available for an additional premium.

Humana, which was founded in 1961, offers Medicare Advantage insurance in all states except Alaska. They provide a variety of plans (HMO, PPO, PFFS, and so on) with monthly rates ranging from $0 to more than $100, depending on your needs and location.

BEST NATIONAL COVERAGE

Aetna

Why We Chose It

Aetna is our top pick for national coverage because it offers policies in all 50 states. The insurer has a nationwide provider network of approximately 1.2 million dental care professionals.

Pros & Cons

Pros

It’s legal in all 50 states.

A large provider network is available.

Home delivery of prescription drugs

Cons

Not all plans are available in every area.

Dental insurance coverage is not included in all plans.

Overview

For its operations in all 50 states, including the District of Columbia and Puerto Rico, we chose Aetna as the best for national coverage. Aetna has roughly 12.7 million dental insurance members, and its network contains about 1.2 million dental care professionals, including over 700,000 primary care doctors and specialists, as well as over 5,700 hospitals.

Aetna offers home delivery of most prescription pharmaceuticals through their mail-order pharmacy, CVS Caremark, with several of their Medicare Advantage plans. Many of Aetna’s Medicare Advantage plans include a concierge service. An Aetna concierge can assist you in managing your health-care costs, understanding your coverage, finding nearby providers, and planning treatments.

Aetna, which was founded in 1853, offers a variety of dental plans (HMO, PPO, EPO, and so on) with monthly costs ranging from $0 to over $100, depending on your needs and area.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

BEST FOR POTENTIAL NEW OFFERINGS

WellCare

Why We Chose It

For a newbie to the field of Medicare Advantage plans, we recommend WellCare. They’re an up-and-coming supplier, having been founded in 1985.

Pros & Cons

Pros

Coverage available over the counter

A customized emergency response system is available to you.

A website that is simple to use.

Cons

Only 27 states have it.

Not as well-known as some of the other providers.

Overview

WellCare is a relatively newer, having been founded in 1985. We chose them as a company to keep an eye on for prospective new Medicare Advantage Plan options for two reasons: WellCare purchased Aetna’s Part D prescription drug plan (PDP) in 2018, and Centene, one of the top Medicaid providers, bought them in 2020. This action could lead to new Medicare Advantage Plan offers that address specific cost or feature requirements.

Over-the-counter (OTC) coverage and access to a personal emergency response system are included in some WellCare Medicare Advantage Plans. The OTC benefit is a set cash amount that can be used to purchase non-prescription drugs and health products that are supplied straight to you. For people who live alone or are left alone for lengthy periods of time, the personal emergency response system is linked to your phone and allows you to summon aid at the touch of a button.

In 27 states, WellCare Medicare Advantage Plans are offered. They provide a variety of plans (HMO, PPO, EPO, and so on) with monthly rates ranging from $0 to more than $100, depending on your needs and area.

BEST FOR SPECIAL NEEDS

Cigna

Why We Chose It

Cigna is a fantastic option if you have particular dental needs as a Medicare senior. They provide customers with special needs plans and a broader range of services.

Pros & Cons

Pros

Plans for people with special needs are available.

Health checks on a regular basis

Increased number of services available

Cons

Only 23 states have it.

Only a few policies include dental insurance coverage.

Overview

Because of their customizable plan offers, we chose Cigna as the best for specific needs. Cigna offers special needs plans that include access to a wider selection of experts as well as regular health insurance assessments, but other Medicare Advantage Plans limit coverage to persons with special health conditions or care needs (beyond annual physicals and care transition assistance).

Cigna provides a wider choice of services, depending on your dental care needs, including more intensive treatments, tailored care, and individualised specialist attention.

The National Committee for Quality Assurance (NCQA) has certified Cigna to operate as a Special Needs Plan (SNP) through 2021, based on an assessment of its Model of Care.

Cigna Medicare Advantage Plan subscribers and their primary care doctors can use a health risk assessment (HRA) to establish tailored treatment plans. The HRA also assists each enrollee in finding the health and wellness services that are most appropriate for them.

Cigna is an American global health care company that was formed in 1792 as the Insurance Company of North America. They provide a variety of plans (HMO, PPO, EPO, and so on) with monthly rates ranging from $0 to more than $100, depending on your needs and area.

Final Verdict

When it comes to dental insurance for medicare beneficiaries, there are numerous possibilities. There are numerous dental plans to pick from if you require additional dental insurance coverage or wish to acquire coverage in the event of a dental emergency. United Healthcare is our top option for a Medicare Advantage dental insurance plans.

Patients can take advantage of United Healthcare’s dental insurance plans, which are both reasonable and accessible. Over 1,300,000 providers are part of the insurer’s network. AARP members also have access to a number of other perks. United Healthcare’s website is straightforward and informative, making it easier to find a plan that suits your requirements.

Compare The Best Dental Insurance for Seniors on Medicare

The average monthly out of pocket costs of the AARP Medigap Plan G for someone 65 years old in states with this pricing structure is $124 per month. The average monthly premium for individuals aged 75 is $199, and for those over 85, it is $209.

The monthly expenses for Plan K, our pick for a low-cost Medicare Supplement plan, range from $58 to $98.

The price hikes at AARP/UnitedHealthcare are predicated on an enrollment discount.

Policyholders aged 65 to 68 receive a 39 percent discount.

The discount is then lowered by three percentage points per year until you reach the age of 81.

You’ll pay the usual rate beyond age 81, with no extra age-related price adjustments.

This pricing structure is unique to AARP, while Humana’s sample Medigap policies have a consistent 3% annual rise.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

What type of coverage can you get?

The advantages of Medicare Supplement plans are the same across the board. This means that an AARP Plan G will provide the same healthcare benefits as another company’s Plan G. This standardization makes it simple to compare policies, and the Medicare.gov Medigap coverage chart can assist you in choosing the best plan for your needs.

When you first become eligible for Medicare or during the open enrollment, you can enroll in a Medigap policy. All Medigap plan letters are available through AARP/UnitedHealthcare. However, available plans may differ depending on where you live and when you first became eligible for Medicare.

What it covers: All Medigap plans cover a portion of Medicare Part A (hospital insurance) and Medicare Part B out-of-pocket payments (deductibles and coinsurance) (medical insurance).

What it doesn’t cover: Prescription medicines are not covered by a supplemental plan. You’ll need a separate Medicare Part D plan for that, and AARP/UnitedHealthcare is the most user-friendly Medicare Part D supplier.