Your best Medicare supplement plans will depend on your health requirements as well as balancing costs. The most comprehensive plan will be insurance Plan G for the current year but will also be the most expensive Medicare medicare supplement insurance plans available.

For seniors, these insurance policies can provide peace of mind and simplify monthly Medicare insurance costs. Without a medigap plan, Original Medicare holders will find that tracking deductibles and paying for regular medical treatment out of pocket can become cumbersome. Furthermore, you may find that there are many different unexpected costs associated with your care.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

How to choose a Medicare supplement plan?

The best Medigap plan (provided by health care providers) for you will depend on which Original Medicare insurance parts you need to be filled and the cost of the insurance plan. You should choose the supplement insurance policy that provides the best basic benefits for you and fills in the insurance coverage gaps where you expect to spend the most on health care.

For example, for the 2022 plan year, the Medicare insurance Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no insurance coverage for this deductible. Therefore, you would be responsible for paying the entire $1,484 out of pocket before your Original Medicare insurance coverage would kick in.

On the other hand, if you selected Medigap Plan G, the entire $1,484 deductible would be covered by your supplement insurance policy. This means you would not need to incur the out-of-pocket costs and would begin getting your insurance claims paid for immediately. However, you should also consider costs, since insurance Plan G can be more expensive than insurance Plan A.

It is for this reason that you should carefully analyze what Medigap plans cover and their costs so that you can choose the best one for your situation. Often, there is an ideal set of supplemental insurance policies for your health care needs.

What is the best Medicare supplement plan?

As mentioned above, your Medicare supplement plan will be the insurance plan that balances costs and coverage. Unfortunately, the most comprehensive insurance plans, C and F, will not be available for new enrollees. In lieu of these new regulations, it is critical to reassess and evaluate all available Medigap policies.

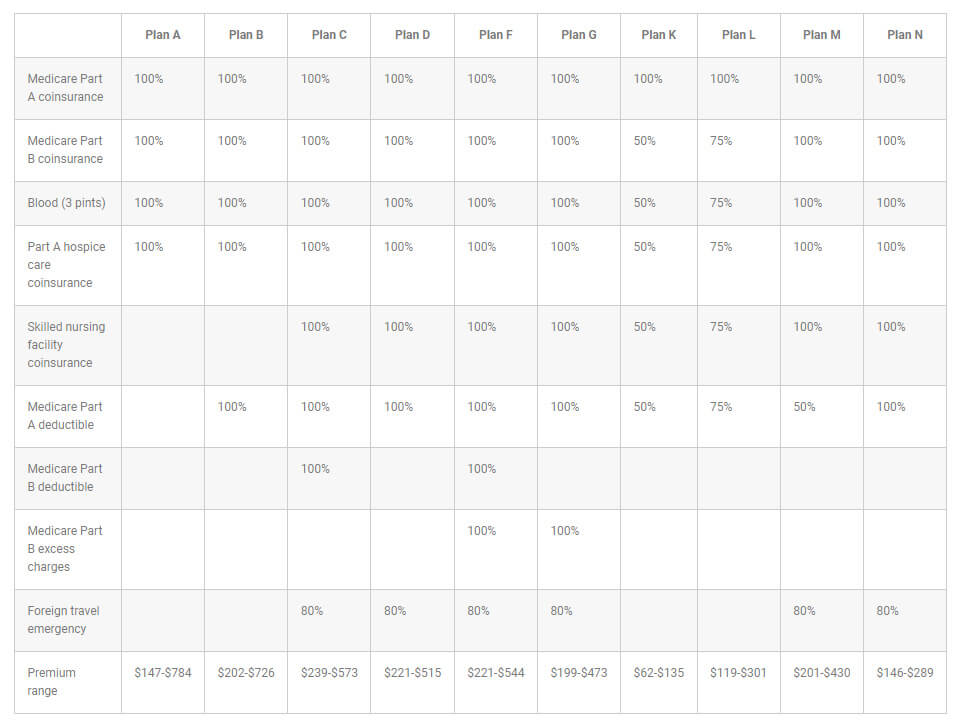

It is important to note that insurance policies that offer more comprehensive insurance coverage for deductibles and care will have significantly higher monthly premiums. Below you can find an analysis of the level of insurance coverage and monthly premium ranges for all of the Medicare supplement coverage.

Prices found below for each Medicare supplement insurance policy will vary by state.

Best overall Medicare supplement for new enrollees: Plan G

Due to the inability of new applicants to buy insurance Plan C and insurance Plan F, Medicare supplement insurance Plan G is the best overall insurance plan that provides the most insurance coverage for seniors. Plan G is very similar to insurance Plan F in that it will cover almost everything except the Part B deductible. This means that you would be responsible for purchasing the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to payout.

However, insurance Plan G will have one of the highest monthly premiums among all the Medicare supplement insurance policies: $473. Therefore, you should weigh the cost of this monthly premium with your potential medical expenses for the year.

Best overall Medicare supplement pre-2020: Plan F

Insurance Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

Insurance Plan F is a good option if you want a comprehensive insurance policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor. The monthly premium for insurance Plan F will be $221. Unfortunately, insurance Plan F will not be available to new Medicare enrollees who become eligible after Jan. 1, 2020. Anyone who currently has Plan F will be able to keep their insurance coverage.

Best cheap Medicare supplement: Plan K

If you are interested in the cheapest Medigap plan that still provides some insurance coverage for Medicare Part and B costs, you may want to look into insurance Plan K.

Insurance Plan K is significantly different from many other Medicare insurance policies since it provides only 50% coverage for Medicare insurance Part B coinsurance, Blood, Part A hospice, skilled nursing, and the Part A deductible. Many other Medigap plans, such as insurance Plan G, provide full reimbursements for these types of health care.

This is crucial to consider if you need health insurance coverage for skilled nursing. In this case, if you were to get health insurance Plan K, only 50% of such costs would be covered.

On the other hand, your monthly premiums will be much cheaper when compared to every other Medicare supplement insurance policy available. Policyholders can expect to pay a monthly premium between $62 and $135.

Best alternative to Plan G Medicare supplement: Plan N

Plan N is a good option for individuals who do not want to buy insurance in Plan G but still want comprehensive Medicare coverage at a cheaper price.

Policyholders of insurance Plan N will miss out on the Federal medicare program Part B deductible and excess charges, which can add up quickly since Part B covers many routine medical expenses like outpatient care and preventive services. For this reason, you should try to forecast your costs and compare them to the annual premium for Medigap Plan N, which is between $1,752 and $3,468.

Does a Medicare supplement plan include Part D?

Prescription drug coverage is included in the majority of Medicare Advantage Plans (Part D). Certain types (of Medicare Advantage plan) allow you to enroll in a separate Medicare Prescription Drug Plan. Drugs are not covered by insurance (like Medicare Medical Savings Account plans)

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

What is the best supplement insurance with Medicare?

- Best Overall: Mutual of Omaha.

- Best User Experience: Humana.

- Best Set Pricing: AARP.

- Best Medigap Coverage Information: Aetna “Aetna medicare supplement plans”.

- Best Discounts for Multiple Policyholders: Cigna.

Who is the largest Medicare supplement insurance companies?

More than 43 million beneficiaries throughout all 50 states and most U.S. territories are served by AARP/United Health Group’s Medicare Supplement plans, making it the largest best Medicare Supplement insurance companies in the country. In order for these policies to be so successful, AARP licenses its name to UnitedHealthCare, the insurance company.