Medicare Supplement Plan A and Medicare Part A are completely different. But Medicare and Medigap are the same. The original Medicare Part A is for the hospital part, but Medicare Supplement Plan A is a supplemental policy.

While Medicare covers most medical expenses, it does not pay for all of its medical services and medical supplies, leaving a gap in your insurance coverage, which is why supplemental insurance coverage has been created.

Medicare Supplemental Insurance Plan A

This plan is sold by private insurance companies to cover part of their out-of-pocket costs that are not covered by Medicare and paid by all beneficiaries. While this doesn’t cover your Medicare Part B premiums, this coverage helps you with coinsurance, deductibles, and co-payments.

All supplement policies must comply with specific federal and state guidelines to protect Medicare beneficiaries. Carriers might only sell insurance coverage that is standardized and meets the basic standards no matter which private insurance company is offering the coverage.

While federal and state laws do mandate the basic services; some plans offer some additional benefits that allow Medicare beneficiaries to choose the best plan to meet their specific needs.

Read More: Costs of Medigap policies

Medicare Supplemental Plan A Coverage

Out of the 10 plans available for 2020, Medicare Supplement A has the lowest benefits. Like other plans, Plan A Medicare supplemental insurance does not provide you with drug coverage.

You must enroll in a separate Medicare prescription drug plan, which is a separate drug plan. The standalone drug plan must work together with your plan A or you can also join a Medicare Advantage plan that is different from another additional plan.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medicare Supplemental Plan A Benefits Eligibility & Enrollment

Eligibility for a Medicare Supplement plan usually requires a person to have traditional Medicare coverage. The best time to buy your policy is during the OEP (Open Enrollment Period). Medigap’s OEP data starts on the first day of the month when you turn 65 or when you are older. You must also be enrolled in Medicare Part B.

This is the period of time in which carriers cannot refuse to sell an individual a policy for pre-existing medical conditions or charge additional fees for health problems that a person may have when joining the plan.

Married couples must have their own insurance policies, as a single plan does not cover both people. Medicare Supplement Plan Availability depends on the state in which you live.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Read More: What to know when buying a Medigap plan to cover medicare costs

Prices for Medicare Supplemental Plan A

Plan A has the lowest coverage and is the most cost-effective Medicare supplemental insurance that requires a monthly premium payment every month.

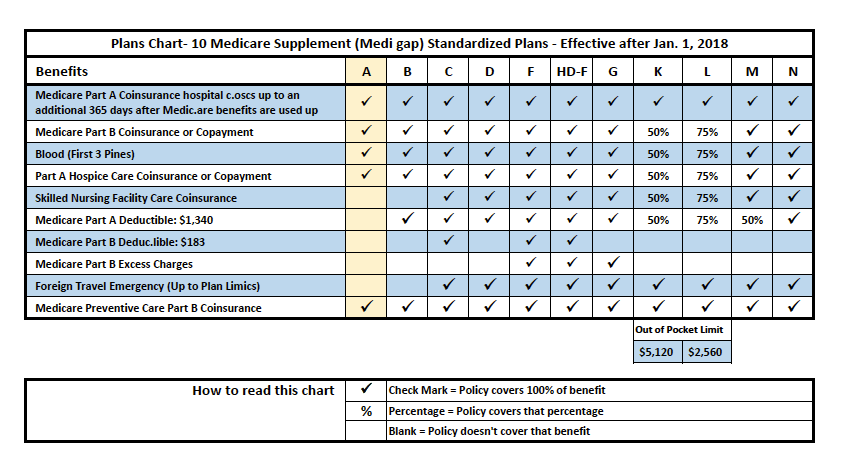

Premiums vary depending on the carrier you choose. There are several different carriers offering plans in each state. Therefore, it is important to compare the different plans to find which ones work best for your specific needs. Use the following table to compare Medigap plan A with the other available options.

Read More: When can I buy Medigap?

FAQs

What is the Medicare premium for 2022?

$170.10

In 2022, the regular Part B premium will be $170.10. The majority of people pay the normal Part B premium. You’ll pay the usual premium amount plus an Income Related Monthly Adjustment Amount if your modified adjusted gross income as reported on your IRS tax return from two years ago is above a particular amount (IRMAA).

What is the average cost of a Medigap plan?

According to industry experts, the average monthly cost of a Medicare supplemental insurance plan, or Medigap, is around $150. These supplemental insurance policies fill in the gaps in Original Medicare coverage (Parts A and B).

What is Plan A in Medigap insurance?

Supplemental insurance for Medicare Instead, Plan A refers to coverage that helps pay for Medicare Part A and Part B out-of-pocket payments. Plan A is needed by law for health insurance providers selling Medicare Supplement insurance policies.

Do Medigap premiums increase with age?

Everyone who has a Medigap policy, regardless of age, is charged the same monthly price. Your insurance premium is not determined by your age. Premiums may rise because of inflation and other circumstances, but they will not rise due to your age.

Will Medicare Part B premium go up in 2022?

Prescription Drugs – Blog > California Health Advocates Why did the Part B premium for Medicare increase by 14.5 percent in 2022? If you’re on Medicare, the 2022 Medicare Part B premium level may have come as a surprise to you. From $148.50 in 2021 to $170.10 in 2022, it increased by $21.60.

What is the deductible for Plan G in 2022?

$2,490

The yearly deductible for these three plans will be $2,490 beginning January 1, 2022. The yearly out-of-pocket expenses (excluding premiums) that a recipient must pay before these policies begin providing benefits are represented by the deductible amount for the high deductible version of plans G, F, and J.

What is the most expensive Medicare supplement plan?

Medigap Plan F is usually the most expensive of the Medicare Supplement insurance plans because it provides the most benefits.

Does Medigap have an out-of-pocket maximum?

Is there an Out-of-Pocket Maximum for Medigap Plans? Because they don’t need one, Medigap plans don’t have a maximum out-of-pocket limit. The coverage is so good that you’ll never have to pay $5,000 in medical expenditures in a year.

Which is better a Medigap policy or Medicare Advantage plan?

In general, Medicare Advantage is a cost-effective option if you are in good health and have few medical bills. However, if you have major medical conditions that require expensive treatment and care, Medigap is usually a better option.

Is Medigap the same as supplemental?

Is there a difference between Medigap and Medicare Supplemental Insurance? Yes, in Spanish. Medigap, or Medicare Supplemental Insurance, is a type of private health insurance that works in conjunction with Medicare to help you pay for your portion of medical expenses. You must get and pay for Medigap coverage on your own.