Costs of Medigap policies: Each insurance company decides how it will set the Costs or premiums, for its Medigap policies. It is important to ask how an insurance company is setting up prices for its policies. The way that companies set the price affects how much you pay now and in the future.

Medigap policies can be priced or “evaluated” in three ways:

Community-rated – also called “no age-rated”

How it’s priced

In general, anyone who has the Medigap policy will be charged the same monthly premium regardless of his/her age.

What does this price mean for you?

Your premium is not based on your age. Premiums may rise due to inflation and other factors, but not because of your age.

| Example |

| Mr. Smith is 65 years old. He buys a Medigap policy and pays a monthly premium of $165. Mrs. Perez is 72 years old. She buys the same Medigap policy as Mr. Smith. She also pays a monthly premium of $165 because everyone pays the same price regardless of age in this type of Medigap policy. |

Read More: Medicare Supplement Plan B

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Issue-age-rated – also called “entry age-rated”

How it’s priced

The premium is based on the age when you purchase (when you’re “issued”) the Medigap Insurance policy.

What can this price mean for you?

Premiums are lower for people who purchase at a younger age and do not change as you get older. Premiums may rise due to inflation and other factors, but not because of your age.

| Example |

| Mr. Han is 65 years old. He purchases a Medigap insurance policy and pays a monthly premium of $145. Mrs. Wright is 72 years old. She purchases the same Medigap insurance policy as Mr. Han. Since she’s older when she purchases it, her monthly premium is $175 |

Attained-age-rated

The premium price is based on your current age (the age you’ve “reached”), so your premium increases as you get older.

What this pricing may mean for you

Premiums are low for younger buyers, but they increase as you get older. They may be the cheapest at first, but eventually, they can become the most expensive. Premiums may also rise due to inflation and other factors.

| Example |

Mrs. Anderson is 65 years old. She buys a Medigap policy and pays a monthly premium of $120. Her premium will increase each year.

Mr. Dodd is 72. He purchases the same Medigap policy as Mrs. Anderson. He pays a monthly premium of $165. His premium is older than Mrs. Anderson’s because It is based on her current age. Mr. Dodd’s premium will increase every year

|

Read More: Medicare Supplement Plan A – Medigap Plan A Rates for 2020

Note: The costs of Medigap Insurance policies can vary widely. There may be big differences in the premiums that different insurance companies charge for exactly the same coverage

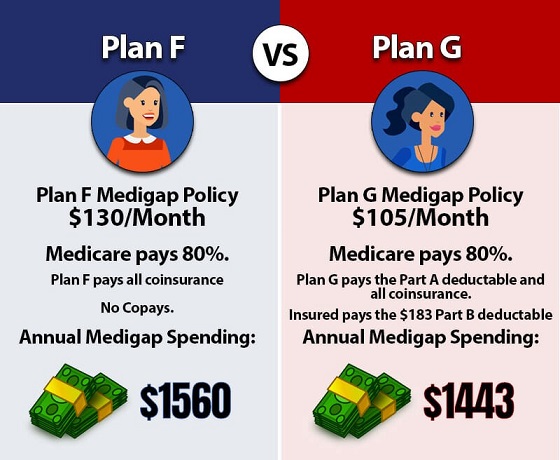

As you shop for a Medigap Insurance policy, be sure to compare the same type of Medigap Insurance policy, and consider the type of pricing used. For example, compare a Medigap Insurance Plan G from one insurance company with a Medigap Insurance Plan G from another insurance company.

The cost of your Medigap policy may also depend on whether the insurance company

- Offers discounts (such as discounts for women, nonsmokers, or married people, discounts for paying yearly; discounts for paying your premiums using electronic funds transfer; or discounts for multiple insurance policies).

- Uses medical underwriting, or applies a different premium when you don’t have a guaranteed issue right (also called “Medigap protections”), or aren’t in a Medigap Open Enrollment Period.

- Sell Medicare Select insurance policies for which you may need to use certain providers. If you buy this type of Medigap insurance policy, your premium could be lower.

- Offers a “high-deductible option” for insurance Plans F or G. If you buy Plans F or G with a high-deductible option, you must pay the first $2,340 of deductibles, copayments, and coinsurance not paid by Medicare before the Medigap insurance policy pays anything. You must also pay a separate deductible ($250 per year) for foreign travel emergency services.

- If you bought your Medigap insurance Plan J before January 1, 2006, and it still covers prescription drugs, you would also pay a separate deductible ($250 per year) for prescription drugs covered by the Medigap insurance policy. And, if you have a Plan J with a high deductible option, you must pay the first $2,340 before the insurance policy pays anything.

Read More: What to know when buying a Medigap plan to cover medicare costs

What are the Average Costs of Medigap policies?

The average national cost of the Medigap F Plan is $1,712 per year, which is about $143 per month.

Why are Medigap policies so expensive?

Younger buyers may find Medicare Supplement Insurance Plans that are evaluated this way, but over time, these plans can become very expensive as their premium increases with age. Premiums may also rise due to inflation and other factors.

Read More: When can I buy Medigap?

Do all doctors accept Medigap?

The short answer is “no”. However, if a doctor accepts Medicare itself for what their primary coverage is, they will also accept your Medigap plan regardless of which company sold you the plan or what Medigap plan you have.

Medigap helps pay your Part B bills

In most Medigap insurance policies, the insurance company Medigap receives your Part B claim information directly from Medicare. Then they pay the doctor directly. Some Medigap insurance companies also offer this service for Part A claims. If your insurance company Medigap does not offer this service, ask your doctors if they “participate” in Medicare. This means they accept “assignments” for all Medicare patients. If your doctor attends, the insurance company Medigap must pay the doctor directly upon request.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

FAQs

Do Medigap premiums increase with age?

Everyone who has a Medigap policy, regardless of age, is charged the same monthly price. Your insurance premium is not determined by your age. Premiums may rise because to inflation and other circumstances, but they will not rise due to your age.

What is the monthly premium for Plan G?

According to Medicare.gov, Medicare Plan G will cost between $199 and $473 per month in 2020. Because each insurance provider employs a different pricing mechanism for plans, you’ll notice a wide range of prices for Medicare supplement coverage. 24th of January, 2022

Are Medigap premiums based on income?

Medicare premiums are calculated using your MAGI (modified adjusted gross income). That’s your total adjusted gross income plus tax-exempt interest, according to the IRS’s most current tax data available to Social Security.

What is the average cost of a Medigap plan?

According to industry experts, the average monthly cost of a Medicare supplemental insurance plan, or Medigap, is around $150. These supplemental insurance policies fill in the gaps in Original Medicare coverage (Parts A and B).

Are AARP Medigap plans community rated?

AARP – Through UnitedHealthcare, AARP offers community-rated Medigap policies, which are quite popular.

Does Medigap go up every year?

Increases in Medigap premiums will occur practically every year. Any agent who tells you differently is a liar. Most Medigap policies increase their rates once a year, generally on the anniversary of your coverage. Instead, some carriers will raise your rates during your birthday month.

Is Plan G guaranteed issue in 2021?

Plan G has some of the most consistent rates of any of the plans. There are a number of compelling reasons for this. First and foremost, Plan G is not available as a “guaranteed issue” (no health questions) alternative for people who are losing group or Medicare Advantage plan coverage.

What is the deductible for Plan G in 2021?

The yearly deductible for these three plans will be $2,370 beginning January 1, 2021. The yearly out-of-pocket expenses (excluding premiums) that a recipient must pay before these policies begin providing benefits are represented by the deductible amount for the high deductible version of plans G, F, and J.

Is Plan G going away?

Plan G of Medicare is not going away. There is a great deal of misunderstanding about which Medigap plans are being phased out and which are still available. Plan G isn’t going away anytime soon. You are free to continue with your plan.

How much does Medicare take out of Social Security?

What are the premiums for Medicare Part B in each income bracket? In 2021, a beneficiary paying the Part B premium paid roughly 9.8% of their income, based on the average social security payout of $1,514. The percentage will rise to 10.6 percent next year.