What’s Medigap: A look at Medigap and its reports on how it works and why older people with Medicare should supplement Original Medicare.

You’re going on Medicare – congratulations! You’ll join nearly 62 million Americans on what many of them claim is the best health insurance plans they’ve ever had.1

So call social security and sign up for Medicare Parts A and B., and then you will find out that Parts A and Parts B don’t pay all bills for your hospital and doctors. They only offer partial coverage and leave some major gaps in those bills for you to pay. Medigap insurance policies are great at protecting you from those coverage “gaps.”

This is where Medigap comes into play. But What’s Medigap Insurance and why do I need to get it?

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

What You Need to Know

- Medigap helps you pay out-of-pocket costs, doesn’t require referrals, and gives you greater doctor choice.

- Medigap automatically works with Medicare and fills in the insurance coverage gaps without input from you.

- You can choose a separate prescription drug insurance policy that fits your healthcare needs.

Read More: Life Insurance Options

What’s Medigap Insurance?

Simply put, Medicare leaves huge gaps to cover your hospital and doctor’s bills. Those gaps in coverage could add up a lot amount of money out of your pocket.

Medigap Insurance is a particular type of health insurance that pays for some (or all) gaps in Medicare Parts A and B.

By spending a little on a Medigap insurance policy every month, you protect yourself from those coverage gaps. Make sense so far?

Why Is It Called a Medicare Supplement?

Medigap Insurance policies are also called “Medicare supplements insurance”, although they don’t add or supplement anything to Medicare. They only pay bills for you, by covering out-of-pocket costs you’d otherwise have to pay by yourself.

What Are the Benefits of Buying a Medigap Insurance Policy?

Have you ever seen a hospital bill in detail? Maybe you had routine surgery and only spent two or three days in the hospital for it. Most likely, the hospital bill will be much higher than what you were expecting. In addition, you have probably received a separate set of doctors’ bills that list things like the surgeon’s bill and the anesthesiologist’s fee.

Because Medicare Parts A and B don’t fully cover all these hospital and medical bills, millions of people join Medigap Insurance policies to pay the remainder.

Medigap Insurance policies offer several key benefits to people with Medicare. When deciding whether a Medicare Supplement insurance plan is right for you, here are a few things you need to know.

Medigap Helps Pay Out-of-Pocket Costs

Unlike most other types of health insurance, Original Medicare has no limit on how high your out-of-pocket costs can get. But Medigap Insurance policies pay some or all of those out-of-pocket costs, giving you peace of mind.

Read More: Compare Medicare Supplement Insurance Plans

Medigap Can Help If You Have a Chronic Illness

Medigap is a good option if you have chronic diseases that require frequent or costly treatment.

If you have an illness that probably requires hospitalization every year or frequent and expensive medical treatment, a Medigap Insurance policy will save you money as opposed to buying a Medicare Advantage plan. The copays, deductibles, and coinsurance under an Advantage plan could be far greater than your monthly premium for a Medigap Insurance policy.

Medigap Doesn’t Require Referrals

With Medigap Insurance, you do not need referrals to see specialists unless you have a Medicare SELECT policy available in some states that functions as a managed care plan and limits it to in-network providers

Greater Doctor Choice with Medigap

Medigap Insurance offers you a wider range of doctors compared to Medicare Advantage. Unless you have a Medicare SELECT plan, your Medigap Insurance policy does not have a specific network of providers as you would with a managed care plan (Medigap Advantage plans are managed care plans). Instead, Medigap Insurance coverage is “Coast to coast”.

Any doctors, hospitals, and Medicare provider who accepts the Medicare assignment (that means they bill Medicare directly) has to take your Medigap insurance regardless of the company from which you purchased it. And if you see a non-participating provider, some Medigap Insurance policies will pay the excess charges you would otherwise have to pay (note that if you see a doctor who has opted out of Medicare altogether, your Medigap Insurance policy will not cover any of their charges, and neither will Medicare)

Medigap Works with Medicare without You

Medigap works automatically and normally without any input from you, working together with your Medicare insurance plan and filling in the coverage gaps after Medicare has paid for your pre-approved treatments. This ease-of-use is a big appeal of owning a Medigap Insurance policy.

Medigap Allows for Separate Drug Coverage

It allows you to have a separate Insurance policy that you can change annually (to always have the lowest possible prescription prices) without affecting your doctor and hospital insurance. More specifically, if you want prescription drug insurance to go with your Medigap insurance policy, as most people do, you would buy a separate policy for that called Medicare Part D (think: D is for medicines).

Types of Medicare Supplement Plans: from Plans A to N

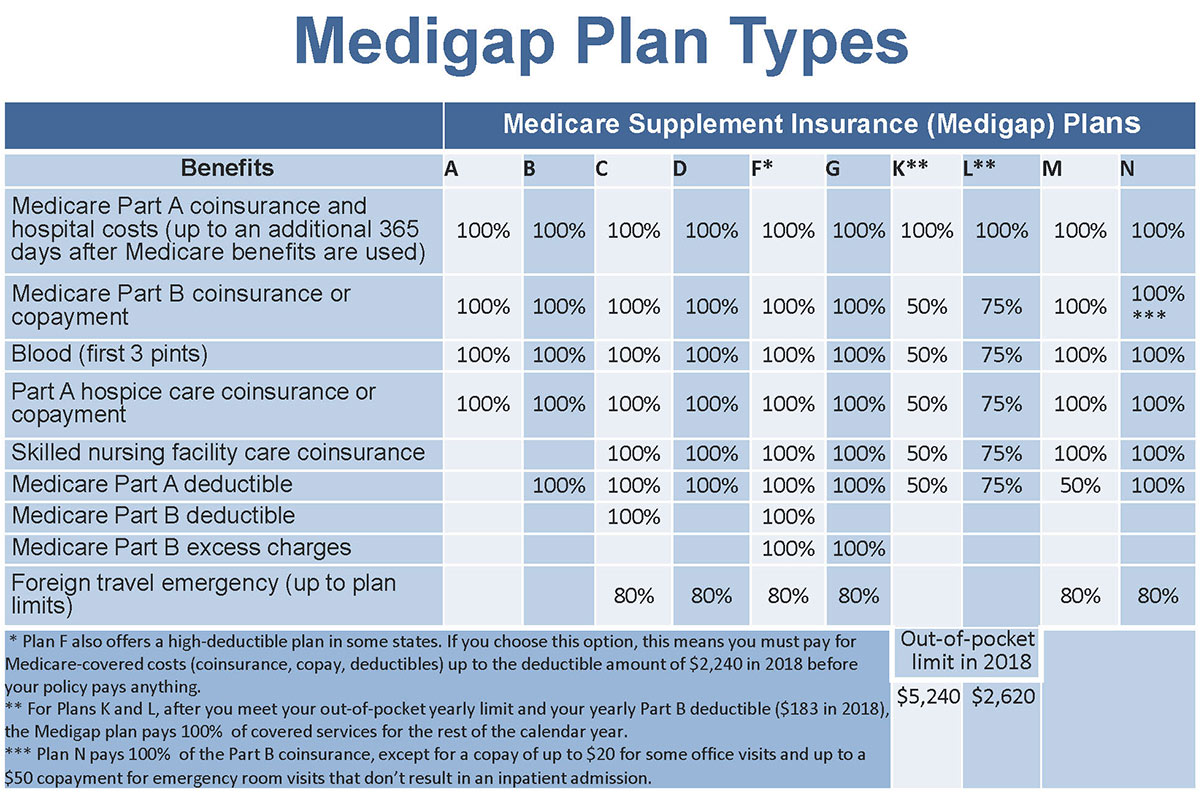

You’ll find that all Medigap Insurance policies have alphabet names, from letters A to N. The most popular Medigap Insurance policies are plans F, G, and N. The only difference between the plans is how much of the coverage gaps they will pay for you. For example, Plan F pays 100% of all gaps in hospital and doctor bills for you. As a result, you wouldn’t have any deductibles or coinsurance at all, just your monthly insurance payment. It’s perfect for people who don’t like to handle out-of-pocket costs when they need medical care.

Plan G is almost the same as plan F, but it’s a little cheaper because you don’t pay the annual Part B deductible. Plan N covers even less of the part B gaps for you and allows you to manage some reasonable copays in exchange for a lower monthly price. Remember that cheaper plans (in terms of monthly premiums) will usually result in higher out-of-pocket costs if and when you need medical care. However, premiums also vary significantly from one health insurer to another, even with the same coverage.

Please also note that Medicare Supplement Plans C and F are not available to Medicare-eligible participants after the end of 2019. If you were previously eligible, you can still purchase these plans.

Medigap Insurance policies are identical across insurance companies. For instance, Medicare Supplement Plan G has identical coverage and benefits regardless of the company you buy it from. The only difference is the way companies determine prices. Premiums can be based on the Community rating, in which each insured person pays the same premium. They can be based on your age when you sign up, or issue-age rating, which helps you when you sign up at a younger age. Or, they can be based on your current age or attained-age rating, which means that premiums keep going up as you get older. Regardless of the pricing method insurers use, though, premiums will increase over time because of medical inflation. medical inflation.

How Do You Buy a Medigap Insurance Policy?

Medigap insurance policies are sold by private Medicare supplementary companies (so you get so much advertising from them when you’re 65 and eligible for Medicare for the first time). Medigap insurance policies can only be purchased individually, which means any Medigap insurance policy you purchase will cover only you. Your spouse or partner must purchase their own individual Medigap insurance policy. However, some companies offer you a discount if you have two people in the same home as their customers.

You can purchase a Medigap insurance policy online, by mail, by phone, or in-person from a professional insurance agent. Prices will vary between different insurance companies. Make sure to compare.

When Can You Buy Medigap?

As soon as you can. The best time to buy your Medigap insurance policy is when you sign up for Medicare insurance Part B for the first time and are at least 65 years old. The government says all insurance companies selling this insurance must give you 6 months from that time to buy a Medigap insurance policy without having to answer health questions (although you can wait for pre-existing condition coverage up to six months after your insurance policy start if you didn’t have prior coverage before enrolling in Medicare and Medigap).

Once this six-month enrollment period expires, you’ll need to respond to a long list of health questions (including having to provide your prescription history) when you request to buy a Medigap insurance policy in most states. You risk being denied coverage by waiting to sign-up.

How Much Is Medigap per month?

The average national cost of the Medigap F Plan is $1,712 per year, which is about $143 per month.

What is the purpose of Medigap?

A Medigap insurance policy is the health insurance that private insurance companies sell to close the “gaps” in coverage under the original Medicare plan. Medigap insurance policies help bear some of the health costs that the Original Medicare Plan doesn’t cover.

Is AARP a Medigap plan?

While Medicare Parts A and B (also called “Original Medicare”) cover some health costs, they don’t pay for everything. An AARP Medicare Supplement Insurance Plan from UnitedHealthcare can help here. Medigap’s Medigap insurance plans are also called “Medigap” and are offered by private insurers.

What is an example of Medigap?

Medigap is additional health insurance that you buy from a private company to cover health costs discovered by Original Medicare, such as copays, deductibles, and health care when traveling outside the U.S. UU. Medigap policy do not include long-term care, dental care, eye care, hearing aids, glasses, and individuals

Who qualifies for BasicMed?

- You must have a valid US driver’s license.

- You must have a medical certificate after July 14, 2006. You must not have refused your last request for a medical certificate.

- You must complete the Basic Med certification process (learn more about this later)

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Read More:

FAQs

What is the difference between Medicare and Medigap?

A Medigap coverage differs from a Medicare Advantage Plan in several ways. A Medigap policy merely supplements your Original Medicare benefits, whereas those plans are means to receive Medicare coverage. The payment of health or prescription medication coverage to Medicare, an insurance company, or a health care plan on a regular basis.

What is Medigap and why would someone choose it?

Why do I require Medigap coverage? Your Original Medicare coverage is supplemented by a Medigap policy, which covers additional costs. Compared to other options, Medigap offers more options and covers a broader network of healthcare providers. Medigap may be a viable alternative for you if you travel or require coverage that Original Medicare does not provide.

What is the main difference between Medicare Advantage and Medigap?

Medigap is a supplement that fills in the gaps by covering out-of-pocket expenditures associated with Original Medicare, whereas Medicare Advantage plans replace Original Medicare and typically give more coverage.

Is Medigap the same as Part B?

The different Medigap plan types cover varying amounts of your Medicare out-of-pocket expenses. It’s important to note that Medigap Plan B is not the same as Original Medicare Part B, despite their similar titles. The following benefits are included in Medigap Plan B: Copayments and coinsurance for Medicare Part B.

Why is Medigap so expensive?

Private insurance companies administer Medigap plans, which Medicare reimburses afterward. As a result, policy premiums vary greatly. For the same coverage, two insurers may charge drastically different premiums. The higher the premium, the more comprehensive the medical coverage.

What is the downside to Medigap plans?

When weighing your options for coverage, consider the following five major drawbacks of Medigap insurance.

- Cost. …

- Not Guaranteed After Open Enrollment. …

- No Part D Coverage. …

- Difficult to Switch. …

- Some Inconsistencies State-to-State. …

- Helps Pay for Medicare Costs. …

- Covers Additional Services.

How do I choose a good Medigap plan?

To obtain a Medigap plan, follow the procedures below:

- Enroll in both Medicare Parts A and B.

- Visit Medicare.gov to see which insurance firms are licensed to sell Medigap plans in your state.

- Costs should be compared between businesses.

- Choose the best Medigap plan for you and purchase your policy.

Does Medigap make sense?

As a result, if you spend a lot of time at the doctor’s office, Medigap can help you save money. You have a lot of out-of-pocket expenses: Consider Medigap if you have trouble paying your deductibles, copayments, or coinsurance. It may be able to assist you in lowering your costs. For example, Medicare Part A and B coinsurance and deductibles are covered by all MedSup plans.

What is not covered by Medicare?

Medical exams required for job applications, life insurance, superannuation, memberships, and government organizations are not covered by Medicare. the vast majority of dental checkups and treatments Physiotherapy, occupational therapy, speech therapy, eye treatment, chiropractic, podiatry, acupuncture, and psychotherapy therapies are all available.

Can Medigap insurance be denied?

According to a Kaiser Family Foundation report, insurance companies can deny private Medigap insurance coverage to seniors after their first enrollment in Medicare if they have a pre-existing medical condition, such as diabetes or heart disease, save in restricted, qualifying conditions.