Find the Best affordable

Medicare Plan

Andrew Smith

How to Sign Up for Medicare: How and When to Enroll

Summary

How to Sign Up for Medicare: When it comes to enrolling in Medicare, you have various alternatives. Medicare enrollment is automatic for some people, but it may not be for others, depending on when and how they become eligible.

How to sign up for Medicare – here’s what you need to know

You can sign up for Medicare Part A and/or Part B in one of the following ways:

- Visit www.SocialSecurity.gov for further information.

- Monday through Friday, from 7 a.m. to 7 p.m., call Social Security at 1-800-772-1213 (TTY users: 1-800-325-0778).

- In-person at a Social Security office near you.

Enroll in Medicare if you worked on a train by calling the Railroad Retirement Board (RRB) at 1-877-772-5772. (TTY users 1-312-751-4701). To speak with an RRB representative, call from 9 a.m. to 3:30 p.m., Monday through Friday.

How do I get a Medicare Supplement Insurance plan?

Only if you already have Original Medicare, Parts A and B, may you purchase a Medicare Supplement insurance plan. Private insurance businesses sell Medicare Supplement Insurance coverage.

Medicare supplement insurance programmes work in conjunction with Original Medicare to cover cost gaps.

If you’re considering a Medicare Advantage plan, keep in mind that you can’t combine it with a Medicare Supplement Insurance plan.

Can I sign up for Medicare plans online?

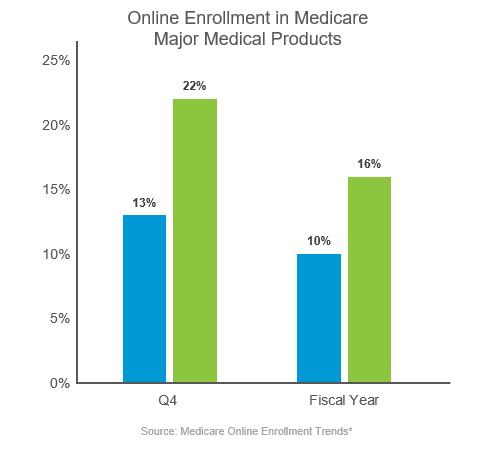

Enrolling in Medicare coverage choices on the internet is usually simple and quick. According to an eHealth study, more people are signing up online. Approximately 16% of respondents in the research enrolled in Medicare coverage options online in 2018. This is up from a low of 10% in 2017. To put it another way, nearly 60% more consumers in the study used eHealth’s online enrollment tool in 2018 than they did in 2017.

Trends in Medicare Online Enrollment* (source: Medicare Online Enrollment Trends)

It’s worth noting that during “Q4,” online enrolment was even higher (22 percent for 2018). The fourth quarter of the year, from October to December, is referred to as Q4. Fall Open Enrollment for Medicare Advantage and Medicare prescription medication programmes occurs at that time. Every year, Fall Open Enrollment runs from October 15 to December 7.

Medicare Enrollment Periods

Here’s a quick review of some key Medicare enrollment dates. More information will be provided later in this post.

Initial Enrollment Period (IEP) – The dates for this time are determined by when you become Medicare eligible. The IEP is normally for a period of seven months. During the IEP, you can enroll in Original Medicare, Parts A, and B, but you can also enroll in a Medicare Advantage plan, a Medicare prescription medication plan, or a Medicare Supplement insurance plan. Later in this post, we’ll go over your IEP in further depth.

General Enrollment Period (GEP): Each year, from January 1 through March 31, there is another opportunity to enroll in Medicare Part A and/or Part B.

Because you are currently covered by group medical insurance through an employer or union, you may choose not to enroll in Medicare Part B when you first become eligible. You can enroll in Medicare at any time while you are still covered by your group plan or during a Special Enrollment Period if you lose your group insurance or wish to move from your group coverage to Medicare (SEP).

Your eight-month special enrollment period begins the month after your employment ends or the month after your group health insurance coverage finishes, whichever comes first. You won’t have to incur a late enrollment penalty if you enrol during a SEP.

If you have ESRD and are eligible for Medicare, the Special Enrollment Period does not apply to you. COBRA and retiree health coverage are not considered current employer coverage and do not qualify you for a special enrollment period.

Annual Election Period: You have various options for changing your coverage (for example, by enrolling in a Medicare Advantage plan or a stand-alone Medicare prescription drug plan). It takes place every year from October 15 to December 7. The AEP will be discussed in greater depth later in this essay.

Medicare Advantage Open Enrollment Period: You can switch Medicare Advantage plans during this time if you already have one. Later in this post, we’ll go over this enrollment period in further depth.

How and when to sign up for Medicare

Will I be automatically enrolled in Medicare?

Enrollment in Medicare may be automatic in the following circumstances:

When to enroll in Medicare if I am receiving retirement benefits

If you join Medicare Part B at the same time you sign up for Railroad Retirement Board or Social Security retirement benefits, you will be automatically enrolled in Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) when you turn 65.

You will be automatically enrolled in Medicare Part A if you live outside of the 50 United States or Washington, D.C. (for example, if you live in Puerto Rico), but you will have to actively enroll in Medicare Part B.

After 24 months of disability benefits, if you are under 65 and receiving certain disability benefits from Social Security or the Railroad Retirement Board, you will be automatically enrolled in Original Medicare, Parts A, and B. If you have an end-stage renal illness, this is an exception (ESRD).

You can apply for Medicare if you have ESRD and have had a kidney transplant or need regular renal dialysis. If you have amyotrophic lateral sclerosis (ALS), often known as Lou Gehrig’s illness, you will be enrolled in Original Medicare the month your disability benefits begin.

When to enroll in Medicare if I am receiving disability benefits

If you’ve been automatically enrolled in Medicare Part B but don’t want to keep it, you have a few options. If your Medicare coverage hasn’t started yet and you’ve received a red, white, and blue Medicare card, you can return it by following the directions on the card. If you keep your Medicare card, you’ll keep your Part B coverage and will be responsible for paying the Part B premiums. If you received Medicare through Social Security, you must contact them to cancel your Part B coverage.

When to enroll in Medicare if I don’t want Medicare Part B

Contact Social Security for advice on how to submit a signed request if your Medicare coverage has begun and you want to discontinue Part B. After Social Security receives your request, your coverage will terminate on the first of the month.

You may choose to postpone Medicare Part B enrollment if you have health coverage via your current employer (either yours or your spouse’s). You should chat with your employer’s health benefits administrator to learn more about how your current coverage interacts with Medicare and the implications of dropping Medicare Part B.

What is the Medicare Part B late-enrollment penalty?

If you do not enroll in Medicare Part B when you first become eligible, you may be charged a late enrollment penalty for the rest of your Medicare coverage. For an entire 12-month period during which you were eligible for Part B but did not take it, your monthly Part B premium might be 10% higher. This higher premium may be in effect for the duration of your Medicare enrollment. There are several Medicare enrollment periods during which you can apply for Medicare if you are not automatically enrolled. There are late-enrollment fines if you don’t sign up for Medicare when you initially become eligible, with some exceptions.

You can delay Medicare Part B enrollment without paying a late-enrollment penalty if you have health coverage via an employer health plan or through your spouse’s employer plan. COBRA and retiree benefits aren’t considered current employer health care because they aren’t dependent on current work.

When is my Medicare Initial Enrollment Period?

Enrollment in Medicare Part A is automatic for the vast majority of people. During your Initial Enrollment Period (IEP), the seven-month period that begins three months before you turn 65, includes the month of your 65th birthday, and ends three months afterward, you may have to manually enroll in Medicare Part A and/or Part B.

The following are some examples of instances when you would enroll in Medicare during your initial enrollment:

When can I enroll in Medicare if I am not receiving retirement benefits?

If you are nearing 65 and do not yet receive retirement benefits, you can enroll in Medicare Part A and/or Part B at your IEP. If you prefer to postpone receiving Social Security or Railroad Retirement Benefits (RRB) until after you turn 65, you can enroll in Medicare only and apply for retirement benefits later.

When can I enroll in Medicare if I do not qualify for retirement benefits?

You will not be automatically enrolled in Original Medicare if you are not eligible for Social Security or RRB retirement benefits. During your IEP, you can still sign up for Medicare Part A and/or Part B. It’s possible that you won’t be able to access Medicare Part A for free, and the cost of your monthly Part A premium will be determined by how long you worked and paid Medicare taxes. There will still be a Medicare Part B premium to pay.

Medicare General Enrollment Period

You can enroll during the General Enrollment Period if you did not enroll during the IEP when you first became eligible. Each year, the regular enrollment period for Original Medicare runs from January 1 to March 31. Keep in mind that if you didn’t sign up for Medicare Part A and/or Part B when you initially became eligible, you may have to pay a late enrollment penalty.

How to Sign up for Medicare Advantage: when can I enroll?

Medicare Advantage, commonly known as Medicare Part C, is a commercial insurance company that has a contract with Medicare. It is another method to access Original Medicare benefits. All Medicare Advantage plans must, at the very least, provide the same Medicare Part A and Part B coverage as Original Medicare. Additional benefits, like prescription drug coverage, are included in some Medicare Advantage plans. To enroll in a Medicare Advantage plan through a private insurer, you must have Original Medicare, Parts A, and B.

During the Initial Coverage Election Period and the Annual Election Period, you can enroll in a Medicare Advantage plan.

What is the Medicare Advantage plan Initial Coverage Election Period?

During the Initial Coverage Election Period, most beneficiaries are initially eligible to enroll in a Medicare Advantage plan. Unless you want to delay Medicare Part B enrollment, this period runs concurrently with your Initial Enrollment Period (IEP), beginning three months before you have both Medicare Part A and Medicare Part B and ending on the later of the following dates:

- The last day of the month before you start having both Medicare Parts A and B

- or the last day of your Medicare Part B Initial Enrollment Period.

If you’re under 65 and have a handicap that qualifies you for Medicare, your IEP will differ based on when your disability benefits began.

When is the Medicare Advantage plan Annual Election Period?

During the Annual Election Period (AEP), which runs from October 15 to December 7, you can add, drop, or change your Medicare Advantage plan. You may do the following during this time:

- Toggle between Original Medicare and a Medicare Advantage plan, or vice versa.

- Change from one Medicare Advantage plan to another.

- Switch from a Medicare Advantage plan that does not cover prescription medicines to a Medicare Advantage plan that does, and vice versa.

When is the Medicare Advantage Open Enrollment Period?

The Medicare Advantage Open Enrollment Opportunity is a one-time annual enrollment period for Medicare Advantage plans. Every year, it runs from January 1 to March 31. You can do the following at this time:

- If you already have a Medicare Advantage plan, you may want to change it.

Return to Original Medicare after disenrolling from your Medicare Advantage plan. - Most other coverage adjustments cannot be made during this time. If you decide to cancel your Medicare Advantage plan, you can utilize this time to enroll in a stand-alone Medicare prescription medication plan, as Original Medicare does not cover prescription drugs.

You can’t alter your Medicare Advantage plan outside of the Annual Election Period and the Medicare Advantage Open Enrollment Period unless you qualify for a Special Election Period.

When can I enroll in Medicare prescription drug coverage?

Prescription drug coverage under Medicare is an option that does not come standard. Prescription medication coverage is available through either a stand-alone Medicare prescription drug plan or a Medicare Advantage plan with prescription drug coverage, often known as a Medicare Advantage Prescription Drug plan. Private insurers provide Medicare prescription medication insurance and Medicare Advantage plans. It’s important to know that you can’t have a stand-alone Medicare prescription drug plan and a Medicare Advantage plan with prescription drug coverage at the same time.

When is my Initial Enrollment Period for Medicare Part D?

During your Part D Initial Enrollment Period, you can enroll in a stand-alone Medicare prescription medication plan. If you meet the following criteria, you may be eligible for prescription drug coverage:

- You have Medicare Part A

- AND/OR Medicare Part B and live in a service area covered by the health plan.

In most cases, your Part D Initial Enrollment Period will coincide with your Medicare Part B Initial Enrollment Period (the seven-month period that starts three months before your eligibility for Part B, includes the month you are eligible, and ends three months later).

You must either enroll in a Medicare prescription drug plan, a Medicare Advantage Prescription Drug Plan, or have creditable prescription drug coverage once you are qualified for Medicare Part D. (that is, prescription drug coverage that is expected to pay at least as much as standard Medicare prescription drug coverage). If they currently have creditable prescription drug coverage through an employer group plan, some persons may choose to postpone enrolling in Medicare Part D.

If you do not sign up for prescription drug coverage when you first become eligible for Part D, you may be subject to a late-enrollment penalty if you go without creditable prescription drug coverage for 63 days or longer.

When is the Medicare Part D Annual Election Period?

If you did not enroll in prescription medication coverage during the IEP, you can do so during the Annual Election Period (AEP), which runs from October 15 to December 7 each year.

You can do the following during AEP:

- Become a member of a Medicare prescription drug plan.

- If you have Medicare, you should drop your prescription medication plan.

- Become a member of a Medicare Advantage plan that covers prescription drugs.

- Change your Medicare Advantage plan from one that doesn’t provide prescription drug coverage to one that does (and vice versa).

Outside of the Part D Initial Enrollment Period and the Annual Election Period, the Medicare Advantage Open Enrollment Period is usually the only time you can make changes to your prescription drug coverage without a qualifying Special Election Period, but only if you are dropping Medicare Advantage and switching back to Original Medicare. The Open Enrollment Period for Medicare Advantage runs from January 1 to March 31.

Prescription drug coverage is not included in Medicare Part A or Part B, and if you return to Original Medicare during the Medicare Advantage Open Enrollment Period, you will have until March 31 to enroll in a stand-alone Medicare prescription drug plan.

How to sign up for Medicare Supplement insurance plans: when can I enroll?

Medicare Supplement insurance plans (also known as Medigap) are optional extra coverage that helps fill in the gaps in Original Medicare coverage. The best time to enroll in a Medicare Supplement insurance plan is during your individual Medigap Open Enrollment Period, which is a six-month period that begins on the first day of the month you turn 65 and have Medicare Part B. If you choose to delay enrollment in Medicare Part B for reasons such as having health coverage through current employment, your Medigap Open Enrollment Period will not begin until you sign up for Part B.

You have a “guaranteed-issue right” to buy any Medigap plan sold in your state during your Medigap Open Enrollment Period. This means that your application for a Medicare Supplement insurance plan cannot be denied because of pre-existing health issues or disabilities. They can’t also charge you a greater premium because of your health. You may not be able to join any Medigap plan outside of this open enrollment period, and insurers may demand you undergo medical underwriting. If you have health issues or disabilities, you may have to pay more.

You may also wonder, “Can you have private insurance and Medicare at the same time?” and how that would operate. Private insurance companies provide Medigap policies, which may be purchased through brokers like eHealth Insurance Services, Inc. It’s a good idea to look into and learn more about these choices.

Frequently asked questions about how and when to sign up for Medicare

Will I be automatically enrolled in Medicare?

When you turn 65 and are currently receiving Railroad Retirement Board or Social Security retirement benefits, you will be immediately enrolled in Original Medicare, Parts A, and B, when you become eligible for Medicare.

Should I sign up for multiple types of Medicare?

Although there are not “many forms of Medicare,” there are several Medicare plan options to consider. In this article about health insurance budgeting, you can learn more about the many types of Medicare coverage.

Do you have any other inquiries? To learn more about a Medicare plan that may be suited for you, contact one of our qualified insurance brokers.

*The online enrollment data in this study are based on applications for MA and Medigap products filed during the fourth quarters of 2017 and 2018 (October through December). This includes the Medicare Annual Enrollment Period, which took place in both years from October 1 to December 7. Unless otherwise stated, “MA” and “Medicare Advantage” refer to all Medicare Advantage programs, including those that provide prescription drug coverage (referred to as “MAPD plans” elsewhere in this report).

These eHealth web pages’ product and service descriptions, if any, are not meant to be offers to sell or solicitations in connection with any product or service. All items are subject to applicable laws, rules, and regulations and are not available in all places.

Read More: Medicare Open Enrollment 2022 Best How to enroll Guide

More to explorer

Early Medicare (How to know If you Are Eligible)

How old do you have to be to get Medicare? Early Medicare: Do you want to know when you can start receiving

Do I need to sign up for Medicare at 65 if I’m still working? (Need to Know)

Q: If I’m still working at 65, do I need to enroll in Medicare? A: Medicare eligibility begins at age 65, and enrolling early

Medicare Open Enrollment 2022 Best How to enroll Guide

Medicare Open Enrollment 2022 Guide: A multitude of techniques is available to verify the status of a Medicare application, including: Using the