Find the Best affordable

Medicare Plan

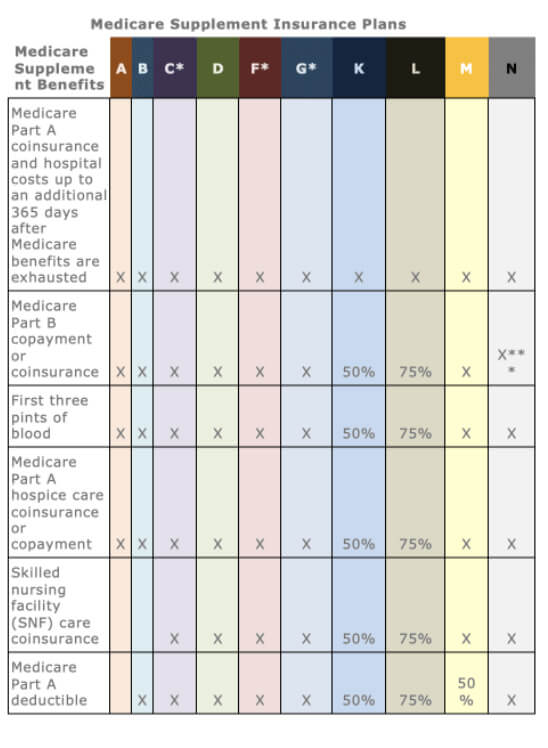

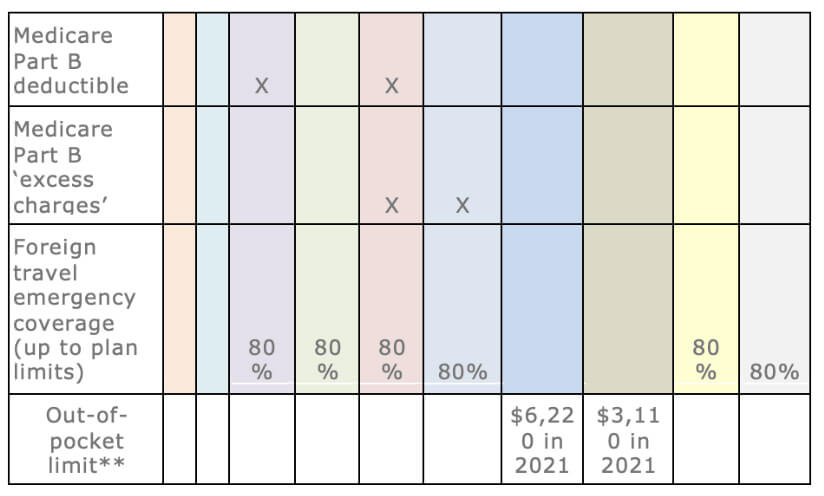

Medicare Supplement Insurance Plans

Summary

Medicare Supplement Insurance plans, often known as Medigap, are offered by private insurance firms to cover a variety of out-of-pocket expenses not covered by Original Medicare, Part A, and Part B.

Medigap insurance may cover the “gap” between what Original Medicare covers and what you have to pay out of cash. Private insurance providers can help you apply for Medicare Supplement Insurance coverage.

What are Medicare Supplement Insurance plans?

- Prescriptions are not covered by today’s Medicare Supplement Insurance policies. You can, however, enroll in a Medicare Part D prescription medication plan on its own.

- There are ten standardized Medigap plans to choose from in most states.

- A, B, C, D, F, G, K, L, M, and N are the letters assigned to Medicare Supplement Insurance Plans A, B, C, D, F, G, K, L, M, and N, respectively (Plans E, H, I, and J are no longer available).

- Medigap plans are standardized differently in Massachusetts, Minnesota, and Wisconsin.

Each of the 10 standardized Medicare Supplement Insurance plans is included in the table below with a summary of benefits. In this chart, an X denotes that the service (or item) is fully covered; a percentage indicates the percentage of the service/item that is covered, and a blank cell indicates that the service/item is not covered.

*In some jurisdictions, Plans F and G include a high-deductible plan. Before your policy pays anything, you must pay all Medicare-covered charges (coinsurance, copayments, and deductibles) up to the deductible amount of the High Deductible Medigap Plan F deductible in 2022. Plans C and F will no longer be accessible to Medicare recipients on or after January 1, 2020. Plan C or Plan F, on the other hand, can be kept if you already have them.

**For the balance of the calendar year, both Medicare Supplement Insurance Plans K and L pay 100 percent of covered treatments in the above chart once you hit the out-of-pocket limits (including the Part B deductible).

***With the exception of a $20 copayment for occasional office visits and a $50 copayment for emergency room visits that do not end in an inpatient admission, Plan N pays 100 percent of Part B coinsurance expenses.

Tip: In your location, all insurance firms selling a specific Medicare Supplement Insurance plan type must provide the same fundamental benefits, but they may charge various costs. As a result, you might wish to shop around for the greatest deal.

Because state and federal laws control Medicare Supplement Insurance plans, the essential benefits provided by plans of the same letter type are generally similar regardless of insurer.

- The pricing and who administers the plan will be the main differences.

- In your location, not all insurers may provide all types of Medicare Supplement Insurance policies.

- Choose a reputable health insurer and shop around for the best deals.

In some states, you may be able to purchase Medicare SELECT, a type of Medigap policy that requires you to use a specific network of doctors and hospitals.

How do I get a Medicare Supplement Insurance plan?

Only if you already have Original Medicare, Parts A and B, may you purchase a Medicare Supplement insurance plan. Private insurance businesses sell Medicare Supplement Insurance coverage.

Medicare supplement insurance programmes work in conjunction with Original Medicare to cover cost gaps.

If you’re considering a Medicare Advantage plan, keep in mind that you can’t combine it with a Medicare Supplement Insurance plan.

When can I get a Medicare Supplement Insurance plan?

The first day of the month in which you are at least 65 and have Medicare Parts A and B begins your Medicare Supplement Open Enrollment Period (OEP). When the firm is required to sell you a Medicare Supplement insurance plan, you have six months to purchase it. If you wait until after your Medigap OEP, you can apply at any time, but if you have health problems, a plan may reject you or charge you more.

After your Medigap OEP, you may have “guaranteed-issue rights” to a Medicare Supplement Insurance plan at later periods.

Let’s imagine you decide to enroll in a Medicare Advantage plan. (Medicare Supplement Insurance policies are not compatible with Medicare Advantage plans.)

- Let’s say you decide to cancel your Medicare Advantage coverage and go back to Original Medicare.

- Assume you’ve been enrolled in a Medicare Advantage plan for a year or fewer.

- You have the option of purchasing a Medicare Supplement (Medigap) coverage.

- Only certain Medigap plans are covered by your “guaranteed issue rights.”

Medicare Supplement coverage of pre-existing conditions

The insurance provider cannot refuse to sell you a Medicare Supplement Insurance plan if you purchase it during the six-month Medicare Supplement Open Enrollment Period. The insurance provider also can’t charge you more or make you wait for basic benefits to start because you have health difficulties.

However, the Medicare Supplement policy’s benefits may not cover your pre-existing condition for up to six months.

A private insurance firm may “underwrite” a Medicare Supplement insurance plan if you apply for it outside of the Medicare Supplement Open Enrollment Period.

Underwriting the plan entails a physical examination, and the insurance company has the option of refusing to sell you the plan or adjusting your premium based on your health status.

How insurance companies set Medigap premiums

An insurance firm can establish Medigap premium rates for Medicare Supplement Insurance policies in one of three ways:

- Premiums for “community-rated” (or “no-age-rated”) policies are the same regardless of age.

- Premiums for “issue-age-rated” (or “entry-age-rated”) policies are calculated based on your age at the time of purchase. The sooner you purchase, the lower your price will be.

- Premiums that are “attained-age-rated” are calculated based on your current age and increase as you get older.

Inflation, geography, medical underwriting (if you didn’t buy a plan when you initially became eligible), and other discounts can all affect the premium costs for Medicare Supplement Insurance plans.

Before you buy, check with each individual health insurance to discover how they establish Medigap pricing.

*Pre-existing conditions are medical conditions that existed before the policy began. They may limit coverage, exclude you from coverage, or even prohibit you from being approved for a policy; however, each plan’s exact definition and applicable limitations or exclusions of coverage will vary, so read the official plan documentation to see how that plan handles pre-existing conditions.

These eHealth web pages’ product and service descriptions, if any, are not meant to be offers to sell or solicitations in connection with any product or service. All items are subject to applicable laws, rules, and regulations and are not available in all places.