Costs of Medigap policies (Affordable policies)

Costs of Medigap policies: Each insurance company decides how it will set the Costs or premiums, for its Medigap policies. It is important to ask how an insurance company is setting up prices for its policies. The way that companies set the price affects how much you pay now and in the future. Medigap policies […]

Medicare Supplement Plan B (affordable Plans)

Medicare Supplement Plan B is just one of the ten different supplementation plans available to Medicare beneficiaries and differs from the regular Medicare B plan, which is not a supplemental plan. These insurance plans are completely different. The original Medicare Plan B is the medical part of your coverage and the Supplemental Guide to Plan […]

Medicare Supplement Plan A – Medigap Plan A Rates for 2020

Medicare Supplement Plan A and Medicare Part A are completely different. But Medicare and Medigap are the same. The original Medicare Part A is for the hospital part, but Medicare Supplement Plan A is a supplemental policy. While Medicare covers most medical expenses, it does not pay for all of its medical services and medical […]

What to know when buying a Medigap plan to cover medicare costs (Affordable Plans)

What to know when buying a Medigap plan to cover medicare costs: What to know when buying a Medigap plan to cover medicare costs, When you sign up for Medicare, sometimes you have to decide that a supplemental plan, also known as Medigap, fits your situation. . However, Medigap plans have limitations that need to […]

When can I buy Medigap? (Important)

Buy a policy when you’re first eligible When can I buy Medigap? The best time to purchase a Medigap policy is during the 6-month open enrollment period of Medigap. In general, you get better prices and more choices among policies. During this time, you can purchase any Medigap policies sold in your state, even if […]

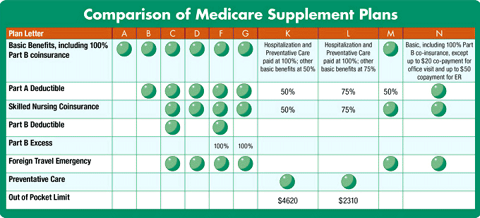

Compare Medicare Supplement Plans (Affordable Plans)

Medicare Supplement plans (also known as Medigap or MedSupp) help cover certain out-of-pocket costs that Original Medicare, Medicare Part A, and B, don’t cover. There are 10 plan types available in most states, and each plan is labeled with a different letter that corresponds with a certain level of basic insurance benefits. In most states, […]

What is Medicare Plan F?

Medicare Plan F offers the most benefits of all the supplemental Medicare plans available and can help reduce your out-of-pocket expenses. The goal of the policy is to address most of the coverage gaps in Medicare Parts A and B. For this reason, many people who are covered by the standard Medicare insurance policies are […]

Medicare Supplement Plan F (Important to Know)

The Medicare Supplement Plan F is generally considered the most comprehensive plan of the 10 Medigap insurance (Medigap) plans available in most states. Its extensive coverage makes it a popular plan for beneficiaries who want to decrease their own out-of-pocket costs in Original Medicare. However, this also means that premiums can be more expensive. Since […]

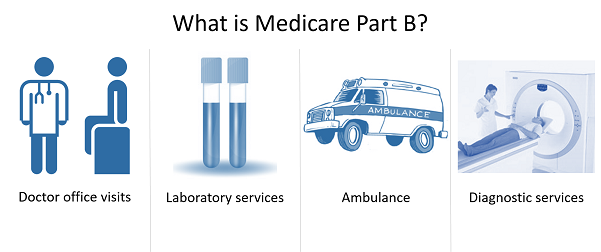

What’s Medicare Supplement Insurance (Medigap)?

Medigap is Medicare supplemental insurance that helps fill “gaps” in Original Medicare and is sold by private companies. Original Medicare pays for a lot, but not all, of the cost for covered health care services and supplies. A Medigap (Medigap) policy can help pay some of the remaining health care costs, Such as: Copayments Coinsurance […]

What’s Medigap (Important to Know)

What’s Medigap: A look at Medigap and its reports on how it works and why older people with Medicare should supplement Original Medicare. You’re going on Medicare – congratulations! You’ll join nearly 62 million Americans on what many of them claim is the best health insurance plans they’ve ever had.1 So call social security and […]