What to know when buying a Medigap plan to cover medicare costs: What to know when buying a Medigap plan to cover medicare costs, When you sign up for Medicare, sometimes you have to decide that a supplemental plan, also known as Medigap, fits your situation. .

However, Medigap plans have limitations that need to be taken into consideration. For example, they do not cover costs related to prescription drug coverage (unless the policy was issued before 2006). Nor will they help you pay for services that are usually excluded from Medicare coverage, such as dentistry or vision.

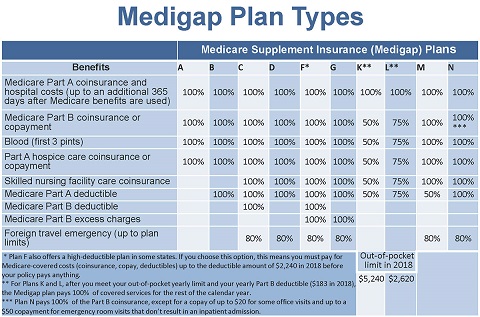

And although the coverage of these policies is generally standardized regardless of which insurance company sells it and where you live (available plans are A, B, C, D, F, G, K, L, M, and N), each of these options offers different levels of coverage. In addition, premiums for plans of the same name can vary significantly from one insurer to another and between locations.

“It’s important not only to use the cheapest plan,” said Elizabeth Gavino, founder of Lewin & Gavino and independent agent and general representative of Medicare plans. Here’s what you need to know.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Read More: Costs of Medigap policies

The basics

About 62.8 million people, most of whom are 65 or older, are enrolled in Medicare. About 43% of beneficiaries choose to receive Part A (hospital coverage) and part B (outpatient care) through an Advantage plan (part C) that offers the most out of pocket and often includes other benefits, such as dentistry and vision.

They usually also include prescription drug coverage but generally you are required to remain in the network. The remaining beneficiaries decide to stick with Basic Medicare and often pair it with a separate Part D drug plan. In this situation, the option to reduce out-of-pocket costs is a Medigap policy, unless you have additional coverage elsewhere (i.e. employer-sponsored insurance).

It’s important to not just go with the cheapest plan.

According to research conducted by AHIP, a commercial health insurance group, about 14.5 million Medicare beneficiaries are included in a Medigap plan. Standardization between Medigap plans means that plan A of one insurance company is the same as plan A for another, However, not all plans are available in all states. In addition, plans C and F are not available to people who are recently eligible for Medicare in 2020 or later.

Each labeled sheet is different in what is covered. The Centers for Medicare and Medicaid Services have a table on their website that shows the differences. You can also use the agency’s search tool to find the plans available in your zip code.

Signing up

When you enroll in Part B for the first time, you usually have six months to purchase a Medigap plan without an insurance company examining your medical history and deciding whether it should be covered. “After this point, you will have a medical underwriting in most states to get a policy,” said Danielle Roberts, co-founder of the insurance company Boomer Benefits.

Despite standardization, the premiums can vary greatly. For example, in a Dallas ZIP Code, the lowest cost of plan G is $99 per month for a 65-year-old woman and the highest cost to the same consumer per month is $242 per month, according to the American Association for Medicare Supplement Insurance.

Whatever plan you choose, premiums tend to increase each year, some more than others, and moving to a different plan can be difficult depending on where you live and whether you need to undergo a medical underwriting.

Read More: Medicare Supplement Plan B

How they are priced

A difference in premiums can arise from how they are “rated”. Knowing this can help you anticipate what might or may not happen to your premium down the road.

Some insurance policies are “community-rated,” meaning anyone who buys a particular plan pays for the same plan regardless of their age.

Others are based on “age reached” which means the rate you get when you purchase it which depends on your age and increases with your age. Still, others use “issue age”: the rate does not change with age, but is based on age at the time of purchasing the policy (so younger people can pay less).

Premiums can also rise year after year due to other factors, such as inflation and insurer increases. It’s worth choosing an insurance company with a good track record, Gavino said.

“Sometimes new carriers come to market and they have really low prices to attract people, but after a year of claims, they may have to increase interest rates significantly,” Gavino said. “I’ve seen it many times.”

Read More: When can I buy Medigap?

Odds & ends

When working with agents, you need to ask yourself how many insurance companies they are working with (or are “appointed with”). They may not recommend the policies of a particular insurer if they do not receive commissions for them.

Also, ask if there is a household discount. Many insurers offer this and this can result in savings of 3% to 14% according to the American Association for Medicare Supplement Insurance.

You can also contact your State Health Insurance Assistance Program or SHIP for free help in choosing a policy.

Does Medigap cover all costs?

Original Medicare pays a large part, but not all costs for covered health care and services. Medicare Supplement Insurance (Medigap) can help pay part of the remaining health costs, such as copays.

What is the average monthly cost of a Medigap plan?

The average cost of the Medigap premium for all plans in 2018 was $152 per month, but some types of Medigap plans have far fewer participants than other types of plans. This difference in enrollment affects the average monthly premium paid by Medigap beneficiaries.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

FAQs

Which is better a Medigap policy or Medicare Advantage plan?

In general, Medicare Advantage is a cost-effective option if you are in good health and have few medical bills. However, if you have major medical conditions that require expensive treatment and care, Medigap is usually a better option.

Plan A of Medicare Supplement Insurance pays for all of the following:

- Coinsurance payments under Medicare Part A for inpatient hospital care for up to an extra 365 days after Medicare benefits have been exhausted.

- Expenses for Medicare Part B copayments or coinsurance.

- The first three pints of blood are given to a patient during a medical procedure.

Which Medigap plan offers the most coverage?

The most comprehensive Medigap plan available is Medicare Supplement Plan F. After Medicare has paid its share, you’ll have 100 percent coverage.

What are the disadvantages of a Medicare Advantage plan?

Medicare Advantage’s Drawbacks

- Restrictive policies may limit the services and medical providers that are covered.

- Copays, deductibles, and other out-of-pocket expenses may be greater.

- The Part B deductible must be paid by the beneficiaries.

- Health-care costs aren’t usually obvious upfront.

- The types of plans that are available vary by location.

Why is Medigap so expensive?

Private insurance companies administer Medigap plans, which Medicare reimburses afterward. As a result, policy premiums vary greatly. For the same coverage, two insurers may charge drastically different premiums. The higher the premium, the more comprehensive the medical coverage.

How do I choose a good Medigap plan?

To obtain a Medigap plan, follow the procedures below:

- Enroll in both Medicare Parts A and B.

- Visit Medicare.gov to see which insurance firms are licensed to sell Medigap plans in your state.

- Costs should be compared between businesses.

- Choose the best Medigap plan for you and purchase your policy.

Is Medigap the same as supplemental?

Is there a difference between Medigap and Medicare Supplemental Insurance? Yes, in Spanish. Medigap, or Medicare Supplemental Insurance, is a type of private health insurance that works in conjunction with Medicare to help you pay for your portion of medical expenses. You must get and pay for Medigap coverage on your own.

Is there a Medicare supplement that covers everything?

Plan F of the Medicare Supplement insurance program provides more coverage than any other plan. It usually includes everything covered under Plan G, as well as: The Medicare Part B deductible will be paid in full in 2021 (the Part B deductible will be $203).

Are Medigap policies guaranteed renewable?

Even if you have health difficulties, any standardized Medigap coverage is guaranteed renewal. This implies that as long as you pay your premiums, your Medigap policy will not be canceled.

What is the difference between Plan G and high deductible plan G?

The deductible is high. Plan G has the same advantages as Plan G. While the monthly premium for High Deductible Plan G is lower, beneficiaries must also pay a higher deductible before obtaining full coverage.