Please review this proposal. If you are ready to move forward, contact your Licensed Agent or Sales Representative to discuss the next steps. Plans quoted in this proposal: 4

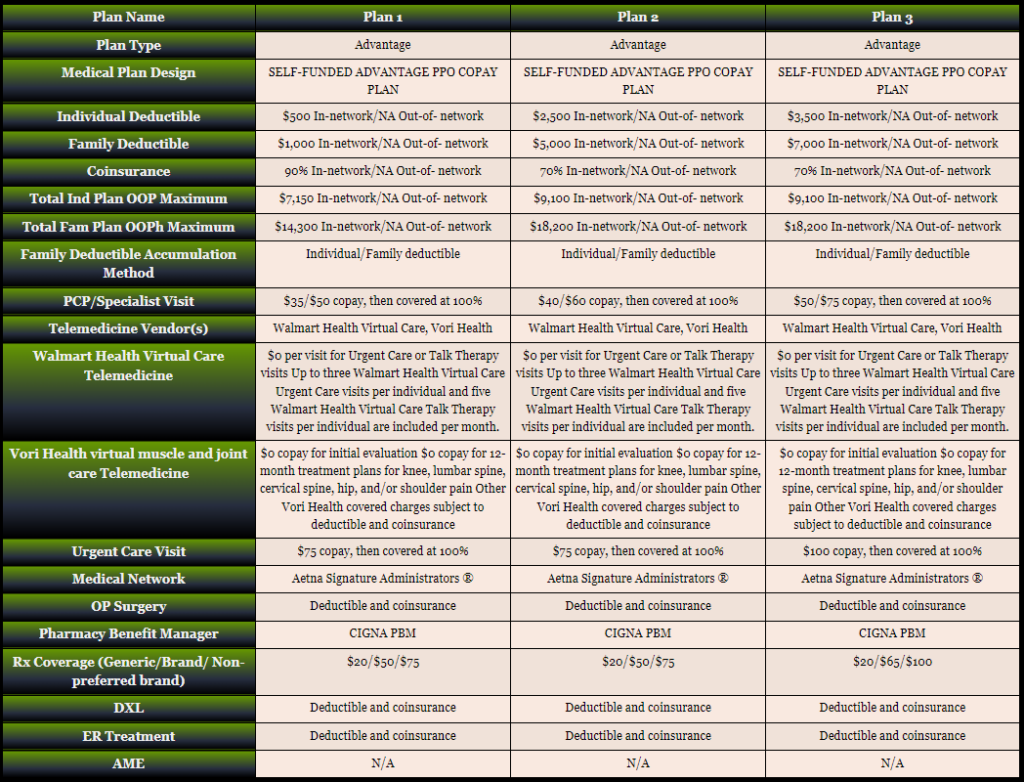

| Plan Name | Plan 1 | Plan 2 | Plan 3 |

|---|---|---|---|

| Plan Type | Advantage | Advantage | Advantage |

| Medical Plan Design | SELF-FUNDED ADVANTAGE PPO COPAY PLAN | SELF-FUNDED ADVANTAGE PPO COPAY PLAN | SELF-FUNDED ADVANTAGE PPO COPAY PLAN |

| Individual Deductible | $500 In-network/NA Out-of- network | $2,500 In-network/NA Out-of- network | $3,500 In-network/NA Out-of- network |

| Family Deductible | $1,000 In-network/NA Out-of- network | $5,000 In-network/NA Out-of- network | $7,000 In-network/NA Out-of- network |

| Coinsurance | 90% In-network/NA Out-of- network | 70% In-network/NA Out-of- network | 70% In-network/NA Out-of- network |

| Total Ind Plan OOP Maximum | $7,150 In-network/NA Out-of- network | $9,100 In-network/NA Out-of- network | $9,100 In-network/NA Out-of- network |

| Total Fam Plan OOPh Maximum | $14,300 In-network/NA Out-of- network | $18,200 In-network/NA Out-of- network | $18,200 In-network/NA Out-of- network |

| Family Deductible Accumulation Method | Individual/Family deductible | Individual/Family deductible | Individual/Family deductible |

| PCP/Specialist Visit | $35/$50 copay, then covered at 100% | $40/$60 copay, then covered at 100% | $50/$75 copay, then covered at 100% |

| Telemedicine Vendor(s) | Walmart Health Virtual Care, Vori Health | Walmart Health Virtual Care, Vori Health | Walmart Health Virtual Care, Vori Health |

| Walmart Health Virtual Care Telemedicine | $0 per visit for Urgent Care or Talk Therapy visits Up to three Walmart Health Virtual Care Urgent Care visits per individual and five Walmart Health Virtual Care Talk Therapy visits per individual are included per month. | $0 per visit for Urgent Care or Talk Therapy visits Up to three Walmart Health Virtual Care Urgent Care visits per individual and five Walmart Health Virtual Care Talk Therapy visits per individual are included per month. | $0 per visit for Urgent Care or Talk Therapy visits Up to three Walmart Health Virtual Care Urgent Care visits per individual and five Walmart Health Virtual Care Talk Therapy visits per individual are included per month. |

| Vori Health virtual muscle and joint care Telemedicine | $0 copay for initial evaluation $0 copay for 12-month treatment plans for knee, lumbar spine, cervical spine, hip, and/or shoulder pain Other Vori Health covered charges subject to deductible and coinsurance | $0 copay for initial evaluation $0 copay for 12-month treatment plans for knee, lumbar spine, cervical spine, hip, and/or shoulder pain Other Vori Health covered charges subject to deductible and coinsurance | $0 copay for initial evaluation $0 copay for 12-month treatment plans for knee, lumbar spine, cervical spine, hip, and/or shoulder pain Other Vori Health covered charges subject to deductible and coinsurance |

| Urgent Care Visit | $75 copay, then covered at 100% | $75 copay, then covered at 100% | $100 copay, then covered at 100% |

| Medical Network | Aetna Signature Administrators ® | Aetna Signature Administrators ® | Aetna Signature Administrators ® |

| OP Surgery | Deductible and coinsurance | Deductible and coinsurance | Deductible and coinsurance |

| Pharmacy Benefit Manager | CIGNA PBM | CIGNA PBM | CIGNA PBM |

| Rx Coverage (Generic/Brand/ Non-preferred brand) | $20/$50/$75 | $20/$50/$75 | $20/$65/$100 |

| DXL | Deductible and coinsurance | Deductible and coinsurance | Deductible and coinsurance |

| ER Treatment | Deductible and coinsurance | Deductible and coinsurance | Deductible and coinsurance |

| AME | N/A | N/A | N/A |

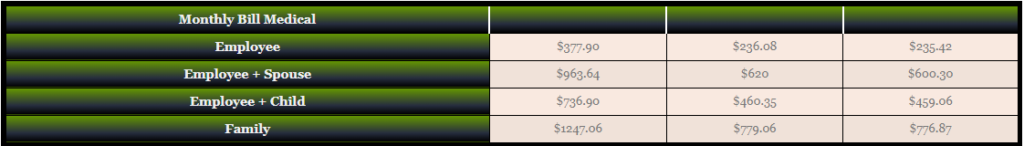

| Monthly Bill Medical | |||

|---|---|---|---|

| Employee | $377.90 | $236.08 | $235.42 |

| Employee + Spouse | $963.64 | $620 | $600.30 |

| Employee + Child | $736.90 | $460.35 | $459.06 |

| Family | $1247.06 | $779.06 | $776.87 |

The Self-Funded Program through Allstate Benefits provides tools for employers owning small to mid-sized businesses to establish a self-funded health benefit plan for their employees. The benefit plan is established by the employer and is not an insurance product. For employers in the Self-Funded Program, stop-loss insurance is underwritten by: Integon National Insurance Company in CT, NY and VT; Integon Indemnity Corporation in FL; and National Health Insurance Company in WA, CO, and all other states where offered.

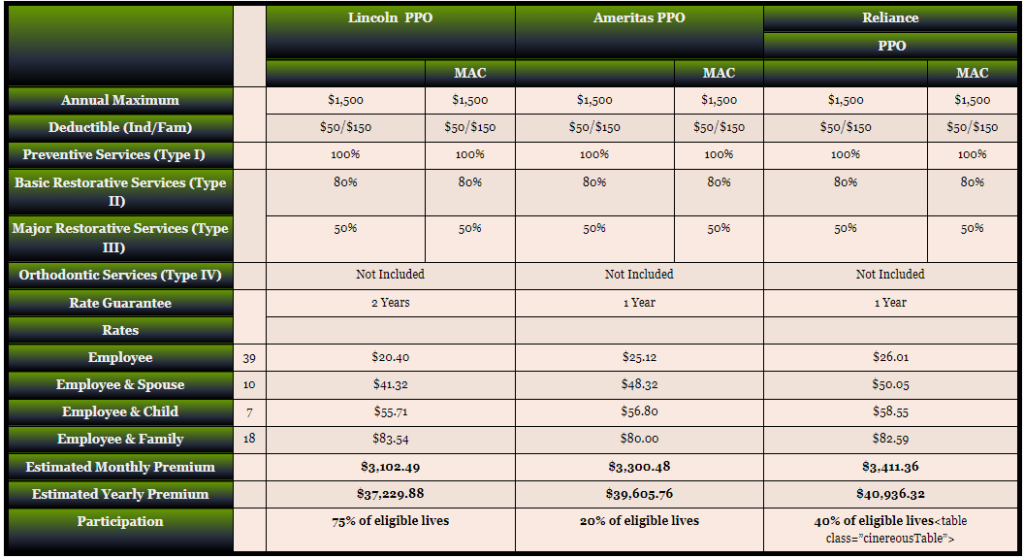

| Lincoln PPO | Ameritas PPO | Reliance | |||||

|---|---|---|---|---|---|---|---|

| PPO | |||||||

| MAC | MAC | MAC | |||||

| Annual Maximum | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | |

| Deductible (Ind/Fam) | $50/$150 | $50/$150 | $50/$150 | $50/$150 | $50/$150 | $50/$150 | |

| Preventive Services (Type I) | 100% | 100% | 100% | 100% | 100% | 100% | |

| Basic Restorative Services (Type II) | 80% | 80% | 80% | 80% | 80% | 80% | |

| Major Restorative Services (Type III) | 50% | 50% | 50% | 50% | 50% | 50% | |

| Orthodontic Services (Type IV) | Not Included | Not Included | Not Included | ||||

| Rate Guarantee | 2 Years | 1 Year | 1 Year | ||||

| Rates | |||||||

| Employee | 39 | $20.40 | $25.12 | $26.01 | |||

| Employee & Spouse | 10 | $41.32 | $48.32 | $50.05 | |||

| Employee & Child | 7 | $55.71 | $56.80 | $58.55 | |||

| Employee & Family | 18 | $83.54 | $80.00 | $82.59 | |||

| Estimated Monthly Premium | $3,102.49 | $3,300.48 | $3,411.36 | ||||

| Estimated Yearly Premium | $37,229.88 | $39,605.76 | $40,936.32 | ||||

| Participation | 75% of eligible lives | 20% of eligible lives | 40% of eligible lives<table class=”cinereousTable”> | ||||

| Lincoln | Ameritas | Reliance | Reliance | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Spectera | EyeMed | VSP | EyeMed | ||||||

| Frequencies | Frequencies | Frequencies | Frequencies | ||||||

| Eye Exam | 12 months | 12 months | 12 months | 12 months | |||||

| Lense Benefit | 12 months | 12 months | 12 months | 12 months | |||||

| Contact Lenses | 12 months | 12 months | 12 months | 12 months | |||||

| Frames | 24 months | 24 months | 24 months | 24 months | |||||

| Reimbursement Schedule | Reimbursement Schedule | Reimbursement Schedule | Reimbursement Schedule | ||||||

| In Network | Out of Network | In Network | Out of Network | In Network | Out of Network | In Network | Out of Network | ||

| Eye Exam | $10 Copay | Up to $40 | $10 Copay | Up to $35 | $10 Copay | Up to $45 | $10 Copay | Up to $35 | |

| Base Lenses | |||||||||

| Single Vision Allowance | $25 Copay | Up to $40 | $25 Copay | Up to $25 | $25 Copay | Up to $30 | $25 Copay | Up to $25 | |

| Bifocal Allowance | $25 Copay | Up to $60 | $25 Copay | Up to $40 | $25 Copay | Up to $50 | $25 Copay | Up to $40 | |

| Trifocal Allowance | $25 Copay | Up to $80 | $25 Copay | Up to $55 | $25 Copay | Up to $65 | $25 Copay | Up to $55 | |

| Lenticular Allowance | $25 Copay | Up to $80 | 20% discount | No benefit | $25 Copay | Up to $100 | 20% discount | No benefit | |

| Contact Lenses | |||||||||

| Elective Allowance | $125 | Up to $125 | $150 | Up to $120 | $150 | Up to $120 | $150 | Up to $120 | |

| Medically Necessary | $25 Copay | Up to $210 | $25 Copay | Up to $210 | $25 Copay | Up to $210 | $25 Copay | Up to $200 | |

| Frame Allowance | $130 | Up to $45 | $150 | Up to $75 | $150 | Up to $75 | $150 | Up to $75 | |

| Rate Guarantee | 2 Years | 2 Years | 2 Years | 2 Years | |||||

| Rates | Option | Option | Option | Option | |||||

| Single | 39 | $6.09 | $7.76 | $6.70 | $6.73 | ||||

| Employee/ Spouse | 10 | $11.54 | $15.36 | $13.06 | $13.33 | ||||

| Employee/ Child(ren) | 7 | $13.55 | $14.08 | $11.70 | $12.24 | ||||

| Family | 18 | $19.03 | $21.68 | $18.05 | $18.84 | ||||

| Monthly Cost | $790.30 | $945.04 | $798.70 | $820.57 | |||||

| Annual Cost | $9,483.60 | $11,340.48 | $9,584.40 | $9,846.84 | |||||

| Participation | 2 enrolled lives | 3 enrolled lives | 10 enrolled lives | 10 enrolled lives | |||||

| Lincoln | Reliance | |

|---|---|---|

| Schedule of Benefits | ||

| Contributions | Voluntary | Voluntary |

| Benefit % | 60% | 60% |

| Maximum Weekly Benefit | $1,500 | $1,000 |

| Benefits Begin: | ||

| Accident | 8th day | 15th day |

| Sickness | 8th day | 15th day |

| Maximum Benefit Period | 13 Weeks | 11 weeks |

| Rate Per $10 Weekly Benefit | Age Banded | Age Banded |

| Total Estimated Volume | Unknown | Unknown |

| Total Employees | 164 | 164 |

| Estimated Monthly STD Premium | Unknown | Unknown |

| Estimated Annual STD Premium | Unknown | Unknown |

| Rate Guarantee | 3 Years | 2 Years |

| Participation | 15% of eligible lives | 30% participation | Age Bands | Rates per $10 of weekly benefit | Rates per $10 of weekly benefit |

| 0-24 | 1.321 | 0.997 |

| 25-29 | 1.321 | 1.181 |

| 30-34 | 1.321 | 1.156 |

| 35-39 | 1.321 | 0.863 |

| 40-44 | 1.378 | 0.974 |

| 45-49 | 1.417 | 0.833 |

| 50-54 | 1.442 | 0.974 |

| 55-59 | 1.476 | 1.157 |

| 60-64 | 1.600 | 1.302 |

| 65-69 | 1.657 | 1.636 |

| 70+ | 1.726 | 2.094 |

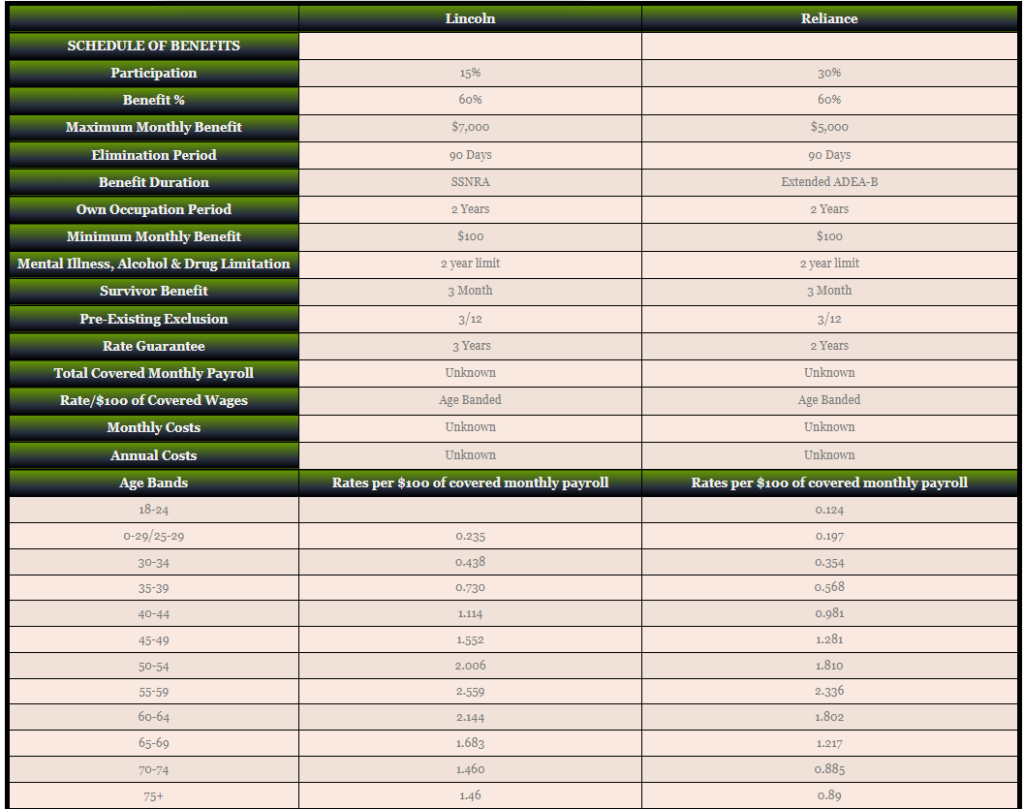

| Lincoln | Reliance | |

|---|---|---|

| SCHEDULE OF BENEFITS | ||

| Participation | 15% | 30% |

| Benefit % | 60% | 60% |

| Maximum Monthly Benefit | $7,000 | $5,000 |

| Elimination Period | 90 Days | 90 Days |

| Benefit Duration | SSNRA | Extended ADEA-B |

| Own Occupation Period | 2 Years | 2 Years |

| Minimum Monthly Benefit | $100 | $100 |

| Mental Illness, Alcohol & Drug Limitation | 2 year limit | 2 year limit |

| Survivor Benefit | 3 Month | 3 Month |

| Pre-Existing Exclusion | 3/12 | 3/12 |

| Rate Guarantee | 3 Years | 2 Years |

| Total Covered Monthly Payroll | Unknown | Unknown |

| Rate/$100 of Covered Wages | Age Banded | Age Banded |

| Monthly Costs | Unknown | Unknown |

| Annual Costs | Unknown | Unknown |

| Age Bands | Rates per $100 of covered monthly payroll | Rates per $100 of covered monthly payroll |

| 18-24 | 0.124 | |

| 0-29/25-29 | 0.235 | 0.197 |

| 30-34 | 0.438 | 0.354 |

| 35-39 | 0.730 | 0.568 |

| 40-44 | 1.114 | 0.981 |

| 45-49 | 1.552 | 1.281 |

| 50-54 | 2.006 | 1.810 |

| 55-59 | 2.559 | 2.336 |

| 60-64 | 2.144 | 1.802 |

| 65-69 | 1.683 | 1.217 |

| 70-74 | 1.460 | 0.885 |

| 75+ | 1.46 | 0.89 |

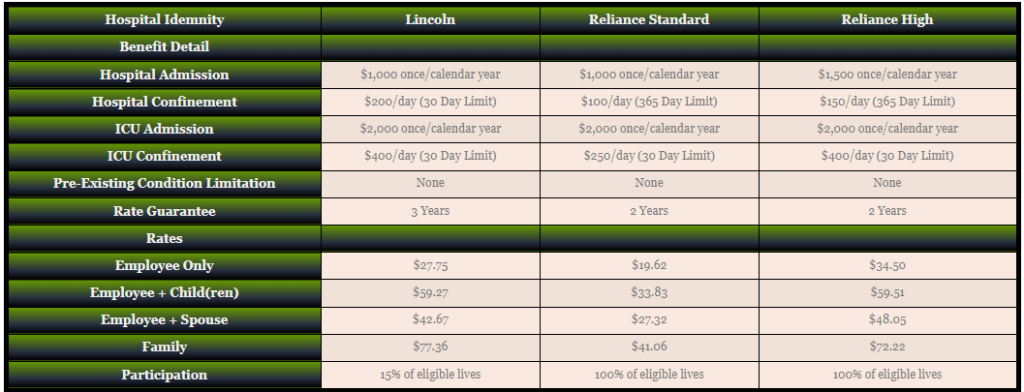

| Hospital Idemnity | Lincoln | Reliance Standard | Reliance High |

|---|---|---|---|

| Benefit Detail | |||

| Hospital Admission | $1,000 once/calendar year | $1,000 once/calendar year | $1,500 once/calendar year |

| Hospital Confinement | $200/day (30 Day Limit) | $100/day (365 Day Limit) | $150/day (365 Day Limit) |

| ICU Admission | $2,000 once/calendar year | $2,000 once/calendar year | $2,000 once/calendar year |

| ICU Confinement | $400/day (30 Day Limit) | $250/day (30 Day Limit) | $400/day (30 Day Limit) |

| Pre-Existing Condition Limitation | None | None | None |

| Rate Guarantee | 3 Years | 2 Years | 2 Years |

| Rates | |||

| Employee Only | $27.75 | $19.62 | $34.50 |

| Employee + Child(ren) | $59.27 | $33.83 | $59.51 |

| Employee + Spouse | $42.67 | $27.32 | $48.05 |

| Family | $77.36 | $41.06 | $72.22 |

| Participation | 15% of eligible lives | 100% of eligible lives | 100% of eligible lives |

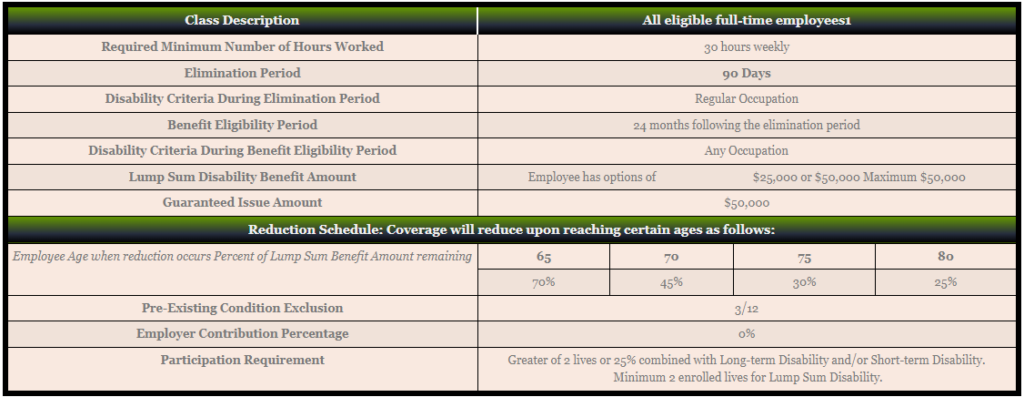

| Class Description | All eligible full-time employees1 | |||

|---|---|---|---|---|

| Required Minimum Number of Hours Worked | 30 hours weekly | |||

| Elimination Period | 90 Days | |||

| Disability Criteria During Elimination Period | Regular Occupation | |||

| Benefit Eligibility Period | 24 months following the elimination period | |||

| Disability Criteria During Benefit Eligibility Period | Any Occupation | |||

| Lump Sum Disability Benefit Amount | Employee has options of $25,000 or $50,000 Maximum $50,000 | |||

| Guaranteed Issue Amount | $50,000 | |||

| Reduction Schedule: Coverage will reduce upon reaching certain ages as follows: | ||||

| Employee Age when reduction occurs Percent of Lump Sum Benefit Amount remaining | 65 | 70 | 75 | 80 |

| 70% | 45% | 30% | 25% | |

| Pre-Existing Condition Exclusion | 3/12 | |||

| Employer Contribution Percentage | 0% | |||

| Participation Requirement | Greater of 2 lives or 25% combined with Long-term Disability and/or Short-term Disability. Minimum 2 enrolled lives for Lump Sum Disability. | |||

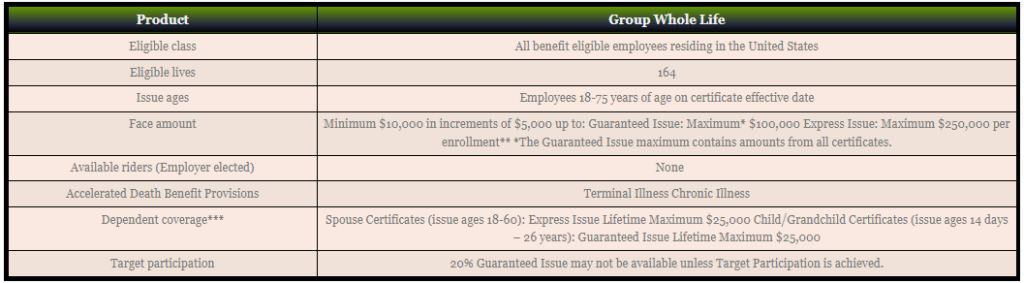

Employee Paid Coverage

| Product | Group Whole Life |

|---|---|

| Eligible class | All benefit eligible employees residing in the United States |

| Eligible lives | 164 |

| Issue ages | Employees 18-75 years of age on certificate effective date |

| Face amount | Minimum $10,000 in increments of $5,000 up to: Guaranteed Issue: Maximum* $100,000 Express Issue: Maximum $250,000 per enrollment** *The Guaranteed Issue maximum contains amounts from all certificates. |

| Available riders (Employer elected) | None |

| Accelerated Death Benefit Provisions | Terminal Illness Chronic Illness |

| Dependent coverage*** | Spouse Certificates (issue ages 18-60): Express Issue Lifetime Maximum $25,000 Child/Grandchild Certificates (issue ages 14 days – 26 years): Guaranteed Issue Lifetime Maximum $25,000 |

| Target participation | 20% Guaranteed Issue may not be available unless Target Participation is achieved. |

**Coverage is limited to a Lifetime Maximum of $1,000,000 and contains amounts from all certificates.

***Employee coverage cannot be less than $25,000 when Dependent Coverage is elected. If elected by the employer, employees must qualify for coverage in order for them to purchase employee dependent coverage options.

As added value to applicants, subject to the terms of the group policy, we will provide interim insurance from the day we receive the application in good order until the effective date of the certificate, not to exceed 90 days.