You have a choice of three medical options to cover yourself and any eligible dependents. In-network preventative care is covered 100% by all plans.

| Deductible | In-Network | Out-of-Network | In-Network | Out-of-Network | In-Network | Out-of-Network |

|---|---|---|---|---|---|---|

| Single | $1,000 | $10,000 | $2,500 | $10,000 | $3,200 | $10,000 |

| Family | $2,000 | $20,000 | $5,000 | $20,000 | $6,400 | $20,000 |

| Coinsurance | ||||||

| Member % | 0% | 50% | 0% | 50% | 10% | 50% |

| Out of Pocket Maximum | ||||||

| Single | $7,000 | $14,000 | $7,000 | $10,000 | $7,050 | $20,000 |

| Family | $14,000 | $20,000 | $14,000 | $20,000 | $14,100 | $40,000 |

| Commonly Used Services | ||||||

| Primary Care Physician Office Visit | $15 | 50% after deductible | $20 | 50% after deductible | deductible and coinsurance | deductible and coinsurance |

| Specialist Office Visit | $30 | 50% after deductible | $40 | 50% after deductible | deductible and coinsurance | deductible and coinsurance |

| Urgent Care | $35 | 50% after deductible | $50 | 50% after deductible | deductible and coinsurance | deductible and coinsurance |

| Emergency Room | $150 | 50% after deductible | $200 | 50% after deductible | deductible and coinsurance | deductible and coinsurance |

| Preventive Care | ||||||

| Preventive Services | 100% | 50% after deductible | 100% | 50% after deductible | 100% | deductible and coinsurance |

| Major Medical Expenses | ||||||

| Inpatient Hospitalization / Surgery | 100% after deductible | 50% after deductible | 100% after deductible | 50% after deductible | deductible and coinsurance | deductible and coinsurance |

| CT scan, PT scan, MRI | 100% after deductible | 50% after deductible | 100% after deductible | 50% after deductible | deductible and coinsurance | deductible and coinsurance |

| Hospital Newborn Delivery | 100% after deductible | 50% after deductible | 100% after deductible | 50% after deductible | deductible and coinsurance | deductible and coinsurance |

| Prescription Drug Coverage | ||||||

| Prescription Deductible | $0 | $0 | $0 | $0 | plan deductible | $0 |

| Generic ( Tier 1 ) | $3 Value Drug/ $5 Preferred | $0 | $3 Value Drug/ $5 Preferred | $0 | $3 Value Drug/ $5 Preferred | $0 |

| Brand Name ( Tier 2 ) | $20 | $0 | $20 | $0 | $20 | $0 |

| Non-Preferred ( Tier 3 ) | $40 | $0 | $40 | $0 | $40 | $0 |

| Specialty ( Tier 4 ) | $150 | $0 | $150 | $0 | $150 | $0 |

| Specialty ( Tier 5 ) | $250 | $0 | $250 | $0 | $250 | $0 |

| Mail Order – 90 day Supply | 2 times copay | $0 | 2 times copay | $0 | 2 times copay | $0 |

| Plan Information | ||||||

| Network Type | POS | POS | POS | |||

| Network Name | Open Access Managed Choice POS | Open Access Managed Choice | Open Access Managed Choice POS | |||

| Member Website | www.aetna.com | www.Aetna.com | www.aetna.com | |||

| Customer Service Phone Number | 800-872-3862 | 800-872-3862 | 800-872-3862 | |||

| Annual Employer Funding (individual/ Family) | ||||||

| N/a | N/a | $750 / $1,200 | ||||

Disclaimer: This is a partial listing of your covered benefits. For a complete accurate listing of covered benefits, limitations and exclusions, refer to your certificate of coverage

| Employee Only | $193.22 | $133.33 | $79.68 |

| Employee + Spouse | $538.37 | $371.50 | $222.00 |

| Employee + Child(ren) | $339.63 | $234.36 | $140.05 |

| Family | $576.37 | $397.72 | $237.67 |

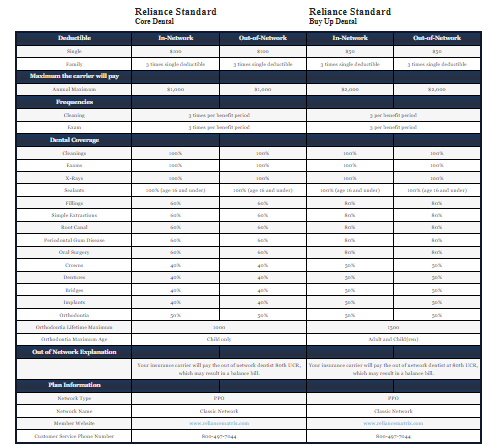

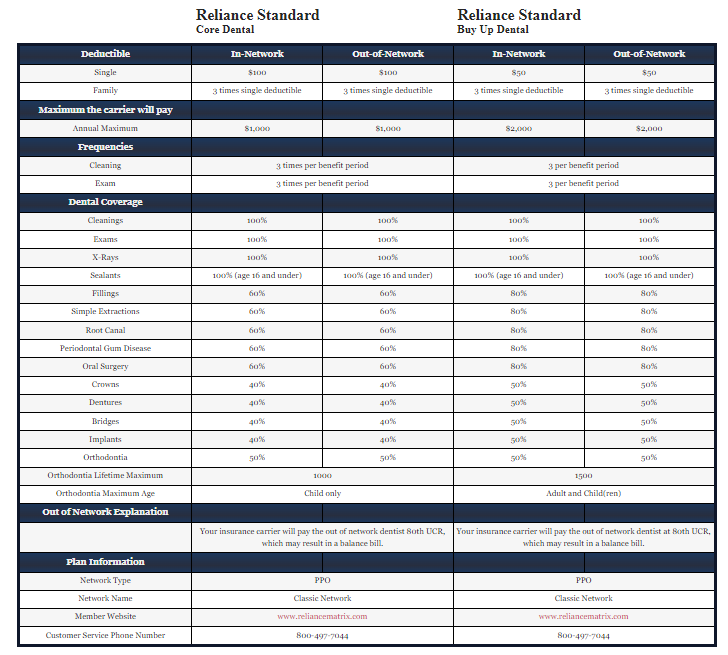

| Deductible | In-Network | Out-of-Network | In-Network | Out-of-Network |

|---|---|---|---|---|

| Single | $100 | $100 | $50 | $50 |

| Family | 3 times single deductible | 3 times single deductible | 3 times single deductible | 3 times single deductible |

| Maximum the carrier will pay | ||||

| Annual Maximum | $1,000 | $1,000 | $2,000 | $2,000 |

| Frequencies | ||||

| Cleaning | 3 times per benefit period | 3 per benefit period | ||

| Exam | 3 times per benefit period | 3 per benefit period | ||

| Dental Coverage | ||||

| Cleanings | 100% | 100% | 100% | 100% |

| Exams | 100% | 100% | 100% | 100% |

| X-Rays | 100% | 100% | 100% | 100% |

| Sealants | 100% (age 16 and under) | 100% (age 16 and under) | 100% (age 16 and under) | 100% (age 16 and under) |

| Fillings | 60% | 60% | 80% | 80% |

| Simple Extractions | 60% | 60% | 80% | 80% |

| Root Canal | 60% | 60% | 80% | 80% |

| Periodontal Gum Disease | 60% | 60% | 80% | 80% |

| Oral Surgery | 60% | 60% | 80% | 80% |

| Crowns | 40% | 40% | 50% | 50% |

| Dentures | 40% | 40% | 50% | 50% |

| Bridges | 40% | 40% | 50% | 50% |

| Implants | 40% | 40% | 50% | 50% |

| Orthodontia | 50% | 50% | 50% | 50% |

| Orthodontia Lifetime Maximum | 1000 | 1500 | ||

| Orthodontia Maximum Age | Child only | Adult and Child(ren) | ||

| Out of Network Explanation | ||||

| Your insurance carrier will pay the out of network dentist 80th UCR, which may result in a balance bill. | Your insurance carrier will pay the out of network dentist at 80th UCR, which may result in a balance bill. | |||

| Plan Information | ||||

| Network Type | PPO | PPO | ||

| Network Name | Classic Network | Classic Network | ||

| Member Website | www.reliancematrix.com | www.reliancematrix.com | ||

| Customer Service Phone Number | 800-497-7044 | 800-497-7044 | ||

Disclaimer: This is a partial listing of your covered benefits. For a complete accurate listing of covered benefits, limitations and exclusions, refer to your certificate of coverage

| Employee Only | $8.52 | $11.79 |

| Employee + Spouse | $19.55 | $27.07 |

| Employee + Child(ren) | $22.00 | $30.46 |

| Family | $33.57 | $46.47 |

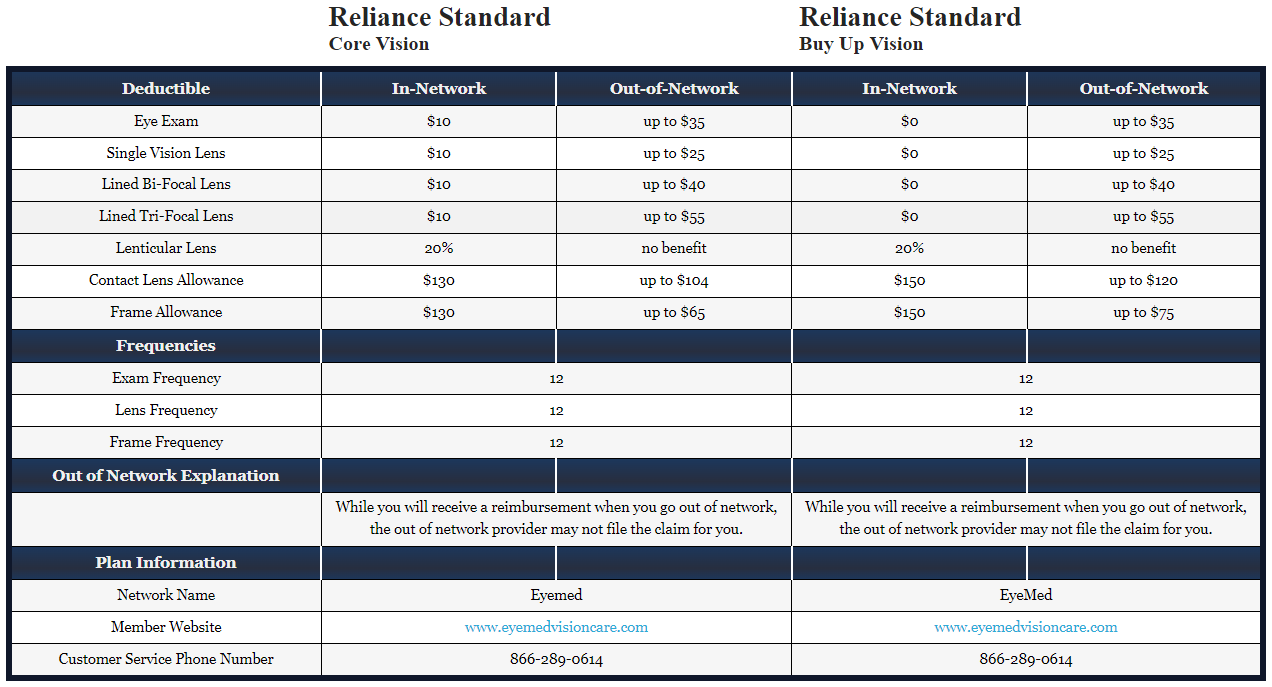

| Deductible | In-Network | Out-of-Network | In-Network | Out-of-Network |

|---|---|---|---|---|

| Eye Exam | $10 | up to $35 | $0 | up to $35 |

| Single Vision Lens | $10 | up to $25 | $0 | up to $25 |

| Lined Bi-Focal Lens | $10 | up to $40 | $0 | up to $40 |

| Lined Tri-Focal Lens | $10 | up to $55 | $0 | up to $55 |

| Lenticular Lens | 20% | no benefit | 20% | no benefit |

| Contact Lens Allowance | $130 | up to $104 | $150 | up to $120 |

| Frame Allowance | $130 | up to $65 | $150 | up to $75 |

| Frequencies | ||||

| Exam Frequency | 12 | 12 | ||

| Lens Frequency | 12 | 12 | ||

| Frame Frequency | 12 | 12 | ||

| Out of Network Explanation | ||||

| While you will receive a reimbursement when you go out of network, the out of network provider may not file the claim for you. | While you will receive a reimbursement when you go out of network, the out of network provider may not file the claim for you. | |||

| Plan Information | ||||

| Network Name | Eyemed | EyeMed | ||

| Member Website | www.eyemedvisioncare.com | www.eyemedvisioncare.com | ||

| Customer Service Phone Number | 866-289-0614 | 866-289-0614 | ||

Disclaimer: This is a partial listing of your covered benefits. For a complete accurate listing of covered benefits, limitations and exclusions, refer to your certificate of coverage

| Employee Only | $2.97 | $4.09 |

| Employee + Spouse | $5.64 | $7.78 |

| Employee + Child(ren) | $5.94 | $8.18 |

| Family | $8.73 | $12.03 |

Life Insurance explanation – brief synopsis of the plan details for the year. This text could include special instructions on how to use the plan, or any other relevant information employees need to know about their plan.

| Life Insurance Benefits | |

|---|---|

| Life Insurance Coverage | 1 times salary rounded to the next $1,000 with a minimum of $50,000 and a maximum of $500,000 |

| Accidental Death & Dismemberment | 1 times salary rounded to the next $1,000 with a minimum of $50,000 and a maximum of $500,000 |

| Age Reduction Schedule | 50% of the amount shown when employee reaches age 65 |

| Plan Information | |

| Member Website | www.oneamerica,com |

| Customer Service Phone Number | 800-352-6608 |

Disclaimer: This is a partial listing of your covered benefits. For a complete accurate listing of covered benefits, limitations and exclusions, refer to your certificate of coverage

| STD Insurance Benefits | |

|---|---|

| Weekly Benefit | 60% to a maximum of $1,800 with a minimum weekly benefit of $25 |

| When do benefits start? (Elimination period ) | 14 days for injury or 14 days for sickness |

| How long do my benefits pay out? | 11 weeks |

| Are there any limitations on coverage for Pre-Existing conditions? | None |

| Plan Information | |

| Member Website | www.oneamerica.com |

| Customer Service Phone Number | 800-352-6608 |

Disclaimer: This is a partial listing of your covered benefits. For a complete accurate listing of covered benefits, limitations and exclusions, refer to your certificate of coverage

| Employer Paid Long Term Disability Insurance Benefits | |

|---|---|

| Monthly Benefit | 60% to a maximum of $10,000 |

| When do benefits start? (Elimination period ) | after 90 consecutive days of Total Disability |

| How long do my benefits pay out? | to SSNRA |

| Are there any limitations on coverage for Pre-Existing conditions? | pre-existing period is 3/12 |

| Own Occupation Limitation | 2 years |

| Plan Information | |

| Member Website | www.oneamerica.com |

| Customer Service Phone Number | 800-352-6608 |

Disclaimer: This is a partial listing of your covered benefits. For a complete accurate listing of covered benefits, limitations and exclusions, refer to your certificate of coverage

| Life Insurance Benefits | |

|---|---|

| Life Insurance Benefits | |

| Employee Life Insurance Coverage | flat amount in $10,000 increments with a minimum of $10,000 and a maximum of $500,000 not to exceed 5 times annual salary, rounded to next higher $1,000 |

| Accidental Death & Dismemberment | flat amount in $10,000 increments with a minimum of $10,000 and a maximum of $500,000 not to exceed 5 times annual salary, rounded to next higher $1,000 |

| Age Reduction Schedule | 50% of amount shown when employee reaches age 65 |

| Guaranteed Insurability | $150,000 guaranteed |

| Plan Information | |

| Member Website | www.oneamerica.com |

| Customer Service Phone Number | 800-352-6608 |

Disclaimer: This is a partial listing of your covered benefits. For a complete accurate listing of covered benefits, limitations and exclusions, refer to your certificate of coverage

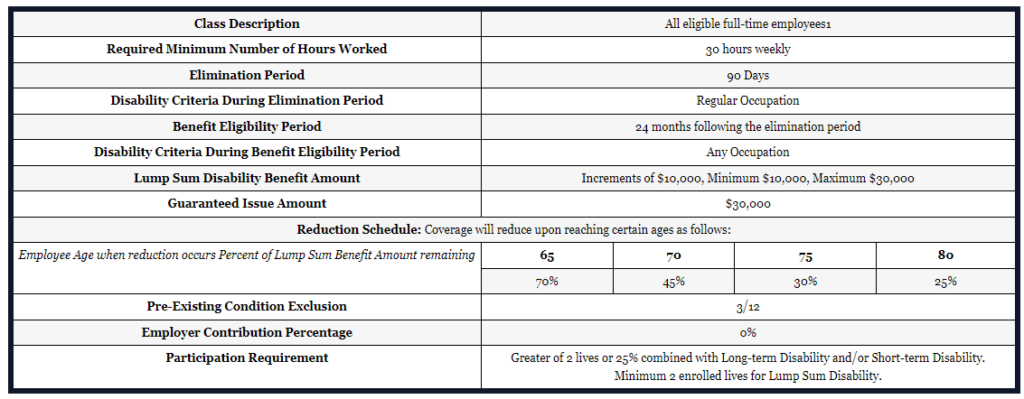

| Class Description | All eligible full-time employees1 | |||

| Required Minimum Number of Hours Worked | 30 hours weekly | |||

| Elimination Period | 90 Days | |||

| Disability Criteria During Elimination Period | Regular Occupation | |||

| Benefit Eligibility Period | 24 months following the elimination period | |||

| Disability Criteria During Benefit Eligibility Period | Any Occupation | |||

| Lump Sum Disability Benefit Amount | Increments of $10,000, Minimum $10,000, Maximum $30,000 | |||

| Guaranteed Issue Amount | $30,000 | |||

| Reduction Schedule: Coverage will reduce upon reaching certain ages as follows: | ||||

| Employee Age when reduction occurs Percent of Lump Sum Benefit Amount remaining | 65 | 70 | 75 | 80 |

| 70% | 45% | 30% | 25% | |

| Pre-Existing Condition Exclusion | 3/12 | |||

| Employer Contribution Percentage | 0% | |||

| Participation Requirement | Greater of 2 lives or 25% combined with Long-term Disability and/or Short-term Disability. Minimum 2 enrolled lives for Lump Sum Disability. | |||

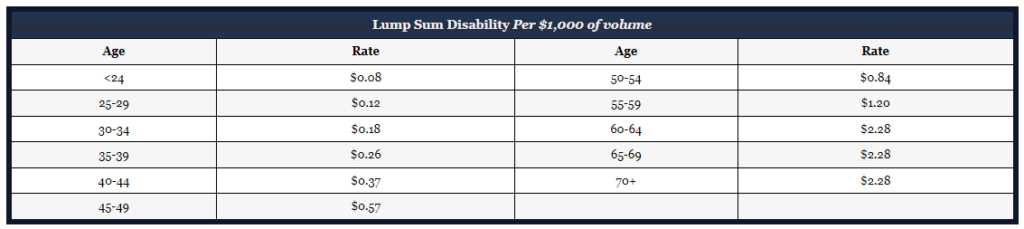

| Lump Sum Disability Per $1,000 of volume | |||

|---|---|---|---|

| Age | Rate | Age | Rate |

| <24 | $0.08 | 50-54 | $0.84 |

| 25-29 | $0.12 | 55-59 | $1.20 |

| 30-34 | $0.18 | 60-64 | $2.28 |

| 35-39 | $0.26 | 65-69 | $2.28 |

| 40-44 | $0.37 | 70+ | $2.28 |

| 45-49 | $0.57 | ||

1Use of the term “Employee” includes employees, owners, members, partners, shareholders, or participants eligible to apply for coverage under American United Life Insurance Company®(AUL) contract

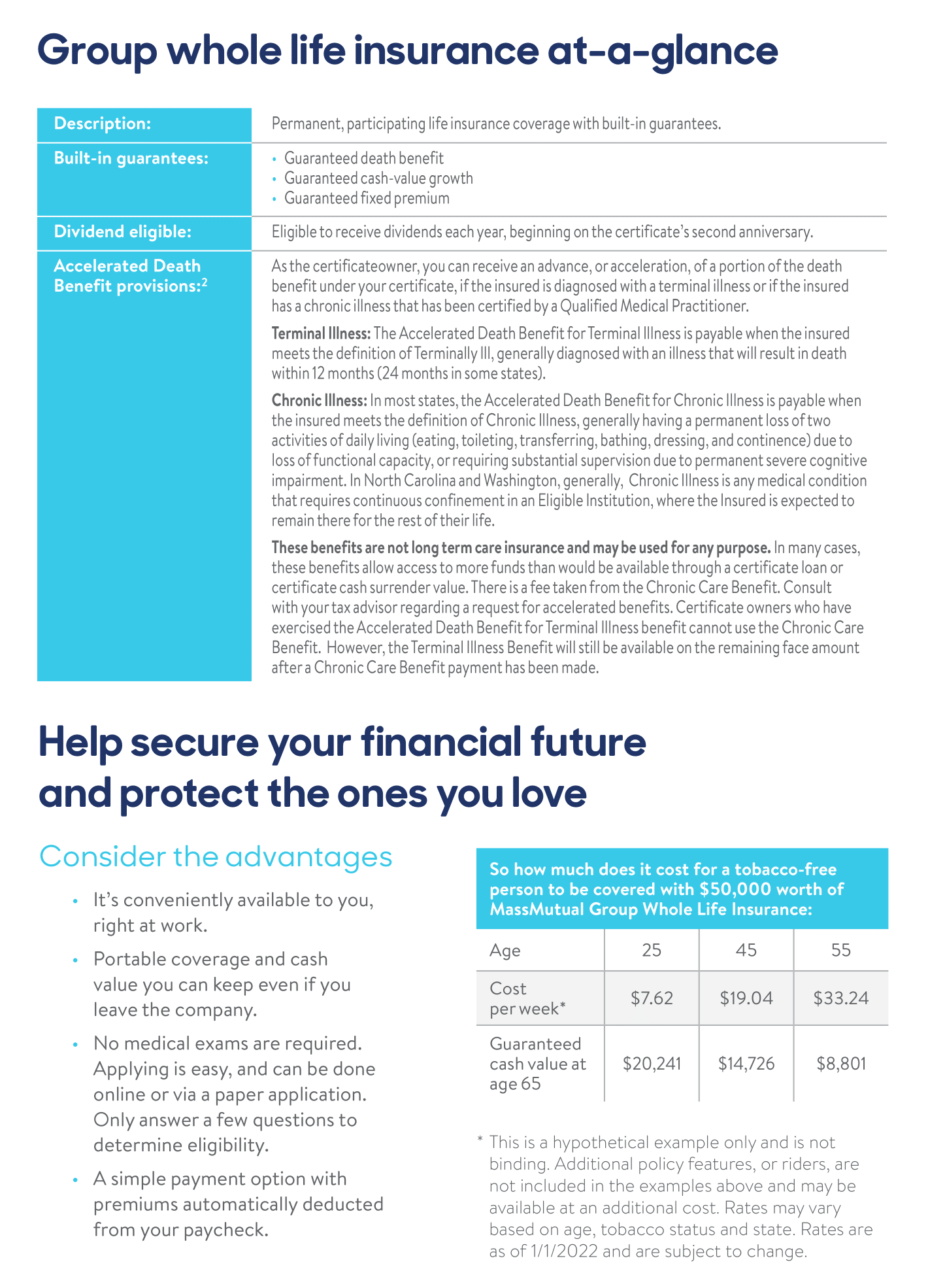

MassMutual@WORK Group Whole Life Insurance provides coverage at a set premium, builds cash value over time that you can borrow from and pays a death benefit. Group Whole Life Insurance may be easier and more affordable

Benefits paid directly to you — to use as you wish — based on the injury and treatments received

| Injury | Scheduled Benefit | Scheduled Benefit |

|---|---|---|

| Burn – 2nd Degree | $800 | $1,600 |

| Burn – 3rd degree | $6,400 | $12,800 |

| Coma | $5,000 | $10,000 |

| Concussion | $100 | $200 |

| Dental Injury | $150 for Crown; $50 for Extraction | $300 for Crown; $100 for Extraction |

| Dislocation – Non-Surgical | $4,000 | $5,008 |

| Dislocation – Surgical | $8,000 | $10,016 |

| Fracture – Non-Surgical | $4,000 | $5,008 |

| Fracture – Surgical | $8,000 | $10,016 |

| Wellness Benefit | $100 | $50 |

| Accidental Death & Dismemberment | $30,000 employee; $12,000 spouse; $6,000 child | $50,000 employee; $20,000 spouse; $10,000 child |

| Plan Information |

Disclaimer: This is a partial listing of your covered benefits. For a complete accurate listing of covered benefits, limitations and exclusions, refer to your certificate of coverage

| Employee Only | $6.10 | $6.96 |

| Employee + Spouse | $9.23 | $10.42 |

| Employee + Child(ren) | $9.69 | $12.88 |

| Family | $13.21 | $16.70 |

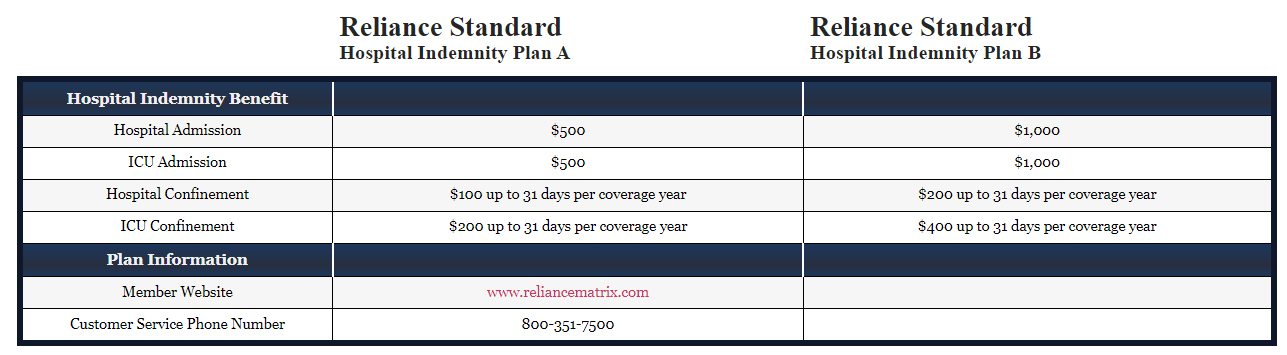

Hospital Indemnity insurance provides you with a benefit when you have an Inpatient or Outpatient surgery, have a major diagnostic scan performed, or even when you need to need to be transported in an ambulance.

Member Websitewww.reliancematrix.comwww.reliancematrix.com

| Hospital Indemnity Benefit | ||

|---|---|---|

| Hospital Admission | $500 | $1,000 |

| ICU Admission | $500 | $1,000 |

| Hospital Confinement | $100 up to 31 days per coverage year | $200 up to 31 days per coverage year |

| ICU Confinement | $200 up to 31 days per coverage year | $400 up to 31 days per coverage year |

| Plan Information | ||

| Customer Service Phone Number | 800-351-7500 | 800-351-7500 |

Disclaimer: This is a partial listing of your covered benefits. For a complete accurate listing of covered benefits, limitations and exclusions, refer to your certificate of coverage

| Employee Only | $4.93 | $11.34 |

| Employee + Spouse | $8.87 | $20.39 |

| Employee + Child(ren) | $6.89 | $15.85 |

| Family | $10.70 | $24.61 |

Pays a lump sum directly to you upon diagnosis of a covered critical illness

| Critical Illness Benefit | |

|---|---|

| Minimum Benefit | $10,000 |

| Maximum Benefit | $30,000 in $10,000 increments |

| Spouse Scheduled Benefit | $10,000 to a maximum of $30,000 in $10,000 increments; not to exceed 100% of approved employee amount |

| Child Scheduled Benefit | 50% of approved employee amount to a maximum of $15,000 |

| Guaranteed Insurability | $30,000 |

| Wellness Benefit | $50 |

| Illness | % of Schedule Benefit |

| Cancer | 100% |

| Cancer – Carcinoma in situ | 25% |

| Heart Attack | 100% |

| Major Organ Failure | 100% |

| Stroke | 100% |

| Plan Information |

Disclaimer: This is a partial listing of your covered benefits. For a complete accurate listing of covered benefits, limitations and exclusions, refer to your certificate of coverage

| 10 Year Age Bands | |||||

|---|---|---|---|---|---|

| Age Bands | Employee | Spouse | Children | ||

| Non-Smoking | Smoking | Non-Smoking | Smoking | ||

| < 20 | $1.20 | $1.20 | $1.20 | $1.20 | $0.70 |

| 20 – 29 | $1.20 | $1.20 | $1.20 | $1.20 | $0.70 |

| 30 – 39 | $2.75 | $2.75 | $2.75 | $2.75 | $1.38 |

| 40 – 49 | $6.20 | $6.20 | $6.20 | $6.20 | $3.10 |

| 50 – 59 | $13.00 | $13.00 | $13.00 | $13.00 | $6.50 |

| 60 – 69 | $26.85 | $26.85 | $26.85 | $26.85 | $13.43 |

| 70 – 79 | $72.10 | $72.10 | $72.10 | $72.10 | $36.05 |

| 80 – 89 | $72.10 | $72.10 | $72.10 | $72.10 | $36.05 |

| 90+ | $72.10 | $72.10 | $72.10 | $72.10 | $36.05 |

A PPO is a type of insurance network. In this type of network, you may choose to obtain care in or out of your network. If you choose to visit a “Preferred”, or “In- Network”, provider, your out of pocket expense will be significantly less than if you visit a provider outside your network. The reason for this is the In-Network provider agrees to accept set, contracted rates as payment in full for their services in return for being part of the insurance carrier’s Preferred Provider network.

An HMO is a type of insurance network. In this type of network, you must stay in your network to obtain care under your plan. There are no benefits paid out for services obtained outside the network. In some instances, HMO’s may require that you have a referral from your primary care physician to obtain services from a specialist.

The amount you pay before the insurance carrier starts sharing the expense of your medical care. Major medical expenses apply to the deductible like inpatient/outpatient surgeries, MRI’s, CT Scans, etc…

This only applies to employees who have dependents enrolled on their plans. In an Embedded deductible, no member of the family unit can satisfy more than the single deductible during the deductible period. Even though the family is subject to the family deductible as a whole, no one person can satisfy more than the single deductible.

This only applies to employees who have dependent enrolled on their plans. In an Aggregate deductible, one member of the family can satisfy the entire family deductible during the deductible period.

This is the 12 month time period in which all medical expenses that would apply to your deductible accumulate. Your deductible will reset after this period ends. This time period is important to note, because it does not always align with your plan year

If your Deductible Period and Plan Year are not the same with your new health insurance carrier, the new carrier will give you “credit” for the portion of the deductible you’ve satisfied with the old health insurance carrier during the most recent Deductible period. In order to obtain this credit, please supply your Plan Administrator with your most recent Explanation of Benefits ( EOB ) from the old carrier.

After you’ve reached your deductible for the year, the insurance carrier will split the balance of the major medical expense with you. They pay a percentage and you pay a percentage of your medical expense until you’ve reached your Out of Pocket Maximum

This is the maximum amount you will pay for covered medical expenses during your deductible period

This is a set Dollar amount you pay when you receive medical care from a PCP, Specialist, Urgent Care, Emergency Room, or Pharmacy. It’s called a CO-pay, because you pay the set dollar amount and your insurance carrier pays the rest of the actual charge from the doctor/facility. Co-pays DO NOT apply to the deductible

When a Provider (doctor, facility, pharmacy or hospital ) contracts with an insurance carrier, they are considered In-Network. Part of the contract states that the provider will accept a lower payment ( lower than what they normally charge ) from the insurance carrier as payment in full. This lower payment is the Negotiated Rate.

Commonly referred to as an “EOB”. The EOB is a very useful document as it explains how the insurance carrier processed your claim. It shows the billed charges from the provider, the network discount applied, and what the resulting Negotiated Rate is. ( Provider Charge – Network Discount = Negotiated Rate ) It also shows whether the service was applied to your deductible or paid as a co-pay. It is not a bill, but merely an explanation of how the insurance carrier paid your claim.

This is an account funded by your employer, where you are reimbursed a % of the covered in-network medical expenses you incur. The goal is to help lower your overall out of pocket expense for the year and not leave you with a high deductible

Premium Saver, administered through a company called The Morgan White Group, is a secondary insurance plan that will pay a large portion of your deductible, so you are not stuck with high out of pocket costs. You will receive a second ID card to give to all doctors and hospitals at the time of service. Your medical plan will always pay the provider 1st and Premium Saver will always pay them 2nd.

This is an Employee Owned savings account that allows you to pay for Qualified Medical Expenses ( IRS Publication 502 ) through tax free contributions. The maximum contributions for 2024 are $4,150 for single coverage and $8,300 for family coverage. Members ages 55-64 can contribute an additional $1,000. If you are age 65 or older, you are no longer eligible to contribute to the H S A. This is a true savings account plan, so you can rollover all unused funds from year to year. With an H S A, money has to be in the account for you to be able to use it.

This is an account funded by the Employee and in part by your employer. The FSA is used to pay for Qualified Medical Expenses ( IRS Publication 502 ) through tax free contributions. The employee chooses the total amount they want in their FSA for the year during open enrollment. That amount is divided up by the number of pays per year and is taken out of each paycheck before taxes. With the FSA, you have access to the Total Amount of funds you Selected during open enrollment at the beginning of your plan year. The maximum amount you can contribute to the FSA is $3,050 in 2024. Typically, you can only rollover $610 from year to year. This is an account funded by the Employee and in part by your employer. The FSA is used to pay for Qualified Medical Expenses ( IRS Publication 502 ) through tax free contributions. The employee chooses the total amount they want in their FSA for the year during open enrollment. That amount is divided up by the number of pays per year and is taken out of each paycheck before taxes. With the FSA, you have access to the Total Amount of funds you Selected during open enrollment at the beginning of your plan year.

New employees are eligible for company insurance benefits: The day after 30 days of continuous full time employment

When your employment with the company is terminated, your benefits will stop: At the end of that month

To be eligible for company benefits, you must be a full time employee working an average of 30 hours per week during the year

Children under the age of 26 are eligible to be covered under the benefits. They will be taken off of the plan at the end of the month in which they turn 26

You can make changes to your plans ( enroll in coverage, waive coverage, add/drop dependents, etc.. ) during this time period each year. Open enrollment occurs 30 days prior to your plan renewal. All changes made during this time period will take effect on the renewal date

If you’ve had a major life event ( getting married, having a child, getting divorced, losing coverage, becoming eligible for Medicare, etc… ) during the year, you’re able to make coverage changes to your plan even though it’s outside of the Open Enrollment window. Please turn in all paperwork within 30 days of your Qualifying Event to ensure it will be processed timely and any claims incurred will be paid. PLEASE NOTE: If adding a newborn baby to your plan, the baby’s social security number will not be available right away. Please submit the paperwork without it, and provide it once’s it’s available

PLEASE NOTE: In the event your employment is terminated with the company, you will receive a packet in the mail giving you the opportunity to continue your Medical, Dental and Vision benefits for up to 18 months. This is called COBRA coverage. Your employer DOES NOT contribute to this coverage as they may when you are employed with them. You will be responsible for 102% of the actual cost of the insurance if you wish to continue with it.

PLEASE NOTE: In the event your employment is terminated with the company, you will receive a packet in the mail giving you the opportunity to continue your Medical, Dental and Vision benefits for up to 12 months. This is called State Continuation, or Mini-COBRA. Your employer DOES NOT contribute to this coverage as they may when you are employed with them. You will be responsible for 102% of the actual cost of the insurance if you wish to continue with it.

Commonly referred to as an “EOB”. The EOB is a very useful document as it explains how the insurance carrier processed your claim. It shows the billed charges from the provider, the network discount applied, and what the resulting Negotiated Rate is. ( Provider Charge – Network Discount = Negotiated Rate ) It also shows whether the service was applied to your deductible or paid as a co-pay. It is not a bill, but merely an explanation of how the insurance carrier paid your claim.

You can register for the insurance carrier’s website where you can print out temporary ID cards and order new cards, or you can contact: Jane Doe at ABC Insurance Services Email: Phone:

PLEASE HAVE COPIES OF YOUR EXPLANATION OF BENEFITS ALONG WITH A COPY OF YOUR BILL(S) READY & CONTACT: Jane Doe at ABC

Insurance Services Email: Phone:

A Health Savings Account ( HSA ) is a personal savings account that you can use to pay for Qualified medical expenses on a tax free basis.

Eligible Expenses under the HSA are called Qualified Medical Expenses ( QME ). These are defined in IRS Publication 502. Examples of qualified medical expenses are Deductibles, Office Visits, Prescription Drugs, Hospital bills, etc… Please note: There are penalties if you use the HSA for Non -QME’s.

In most cases, your HSA bank will provide you with a debit card. Use this to be for any prescriptions or doctor visits at the time of service or you can use it to pay for any bills you receive in the mail.

Typically, you’ll enroll in an HSA during your open enrollment period when you make your annual benefit elections.

Through a debit card or checks provided by the HSA bank you use.

Generally, no. You cannot contribute after you turn 65, but you can use any funds you have left in your account.

The goal of the HSA is to allow you to pay for medical expenses tax free. If you choose to contribute via payroll deductions, the money is taken out pre- tax. If you make contributions on your own, you will be able to deduct these amounts from your taxes for that year.

Yes. For 2024, if you are enrolled in employee only coverage, you can contribute up to $4,150 during the year. For family coverage, this limit is

$8,300. If you are between ages 55 and 64, you can contribute an extra

$1,000 per year.

Generally, no. You cannot use HSA funds to pay for insurance Premiums. There are a couple caveats to this. You can purchase long term care insurance ( specific age guidelines apply ), COBRA coverage and Medicare supplement coverage with HSA funds.

Employees and their dependents that are enrolled in a Qualified High Deductible health plan.

No – all unused funds remain in your account – just like a regular savings account.

In most cases, your employer will allow you to contribute through pre-tax payroll deductions. You can also contribute outside of payroll – be sure to talk to your tax consultant about these contributions to make sure you receive all the tax benefits available.

Yes.

Employee Only Amount: Family Amount:

Yes. The HSA is your personal savings account. The money in this account is yours no matter where you are employed.

1-800-357-6246

An FSA is an employer-sponsored spending account that allows employees to set aside pretax earnings to pay for eligible health care or dependent care expenses.

Eligible Expenses under the FSA are called Qualified Medical Expenses ( QME ). These are defined in IRS Publication 502. Examples of qualified medical expenses are Deductibles, Office Visits, Prescription Drugs, Hospital bills, Dental charges, Lenses & Frames, etc…

This depends on how you have your plan set up. In most cases, yes, it’s a good idea to save receipts.

Since the contributions are made via pre-tax payroll deductions you may only enroll at open enrollment or when you have a mid year qualifying event.

Since this is an employer owned account, you have access to all funds from the 1st day of the plan year.

Yes, in 2024, you can contribute up to $5,000 into your Dependent Care FSA tax free.

You are able to pay for QME’s through pre-tax FSA contributions.

Yes, in 2024, you can contribute up to $3,050 into your FSA tax free.

Your employer will provide you with a debit card that you can swipe, or you may have to submit claim forms or receipts along with itemized bills from your provider to obtain reimbursement.

Full time employees are eligible to participate and contribute to FSA’s. Business owners are generally not eligible.

This depends on how your plan is set up. In most cases, you must use all or the bulk of your funds before the end of the year. You may have the option to rollover up to $610 from year to year.

You contribute to the FSA through pre-tax payroll deductions.

This depends on how your employer chooses to set this up.

No – this is an employer owned account and it is not portable.

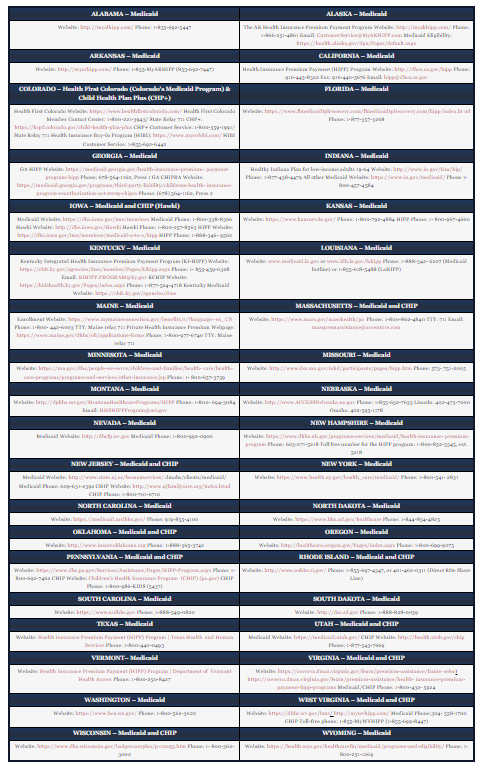

If you or your children are eligible for Medicaid or CHIP and you’re eligible for health coverage from your employer, your state may have a premium assistance program that can help pay for coverage, using funds from their Medicaid or CHIP programs. If you or your children aren’t eligible for Medicaid or CHIP, you won’t be eligible for these premium assistance programs but you may be able to buy individual insurance coverage through the Health Insurance Marketplace. For more information, visit www.healthcare.gov.

If you or your dependents are already enrolled in Medicaid or CHIP and you live in a State listed below, contact your State Medicaid or CHIP office to find out if premium assistance is available.

If you or your dependents are NOT currently enrolled in Medicaid or CHIP, and you think you or any of your dependents might be eligible for either of these programs, contact your State Medicaid or CHIP office or dial 1-877-KIDS NOW or www.insurekidsnow.gov to find out how to apply. If you qualify, ask your state if it has a program that might help you pay the premiums for an employer-sponsored plan.

If you or your dependents are eligible for premium assistance under Medicaid or CHIP, as well as eligible under your employer plan, your employer must allow you to enroll in your employer plan if you aren’t already enrolled. This is called a “special enrollment” opportunity, and you must request coverage within 60 days of being determined eligible for premium assistance. If you have questions about enrolling in your employer plan, contact the Department of Labor at www.askebsa.dol.gov or call 1-866-444-EBSA (3272).

If you live in one of the following states, you may be eligible for assistance paying your employer health plan premiums. The following list of states is current as of July 31, 2023. Contact your State for more information on eligibility –

| ALABAMA – Medicaid | ALASKA – Medicaid |

|---|---|

| Website: http://myalhipp.com/ Phone: 1-855-692-5447 | The AK Health Insurance Premium Payment Program Website: http://myakhipp.com/ Phone: 1-866-251-4861 Email: CustomerService@MyAKHIPP.com Medicaid Eligibility: https://health.alaska.gov/dpa/Pages/default.aspx |

| ARKANSAS – Medicaid | CALIFORNIA – Medicaid |

| Website: http://myarhipp.com/ Phone: 1-855-MyARHIPP (855-692-7447) | Health Insurance Premium Payment (HIPP) Program Website: http://dhcs.ca.gov/hipp Phone: 916-445-8322 Fax: 916-440-5676 Email: hipp@dhcs.ca.gov |

| COLORADO – Health First Colorado (Colorado’s Medicaid Program) & Child Health Plan Plus (CHP+) | FLORIDA – Medicaid |

| Health First Colorado Website: https://www.healthfirstcolorado.com/ Health First Colorado Member Contact Center: 1-800-221-3943/ State Relay 711 CHP+: https://hcpf.colorado.gov/child-health-plan-plus CHP+ Customer Service: 1-800-359-1991/ State Relay 711 Health Insurance Buy-In Program (HIBI): https://www.mycohibi.com/ HIBI Customer Service: 1-855-692-6442 | Website: https://www.flmedicaidtplrecovery.com/flmedicaidtplrecovery.com/hipp/index.ht ml Phone: 1-877-357-3268 |

| GEORGIA – Medicaid | INDIANA – Medicaid |

| GA HIPP Website: https://medicaid.georgia.gov/health-insurance-premium- payment-program-hipp Phone: 678-564-1162, Press 1 GA CHIPRA Website: https://medicaid.georgia.gov/programs/third-party-liability/childrens-health- insurance-program-reauthorization-act-2009-chipra Phone: (678) 564-1162, Press 2 | Healthy Indiana Plan for low-income adults 19-64 Website: http://www.in.gov/fssa/hip/ Phone: 1-877-438-4479 All other Medicaid Website: https://www.in.gov/medicaid/ Phone 1-800-457-4584 |

| IOWA – Medicaid and CHIP (Hawki) | KANSAS – Medicaid |

| Medicaid Website: https://dhs.iowa.gov/ime/members Medicaid Phone: 1-800-338-8366 Hawki Website: http://dhs.iowa.gov/Hawki Hawki Phone: 1-800-257-8563 HIPP Website: https://dhs.iowa.gov/ime/members/medicaid-a-to-z/hipp HIPP Phone: 1-888-346- 9562 | Website: https://www.kancare.ks.gov/ Phone: 1-800-792-4884 HIPP Phone: 1- 800-967-4660 |

| KENTUCKY – Medicaid | LOUISIANA – Medicaid |

| Kentucky Integrated Health Insurance Premium Payment Program (KI-HIPP) Website: https://chfs.ky.gov/agencies/dms/member/Pages/kihipp.aspx Phone: 1- 855-459-6328 Email: KIHIPP.PROGRAM@ky.gov KCHIP Website: https://kidshealth.ky.gov/Pages/index.aspx Phone: 1-877-524-4718 Kentucky Medicaid Website: https://chfs.ky.gov/agencies/dms | Website: www.medicaid.la.gov or www.ldh.la.gov/lahipp Phone: 1-888-342- 6207 (Medicaid hotline) or 1-855-618-5488 (LaHIPP) |

| MAINE – Medicaid | MASSACHUSETTS – Medicaid and CHIP |

| Enrollment Website: https://www.mymaineconnection.gov/benefits/s/?language=en_US Phone: 1-800- 442-6003 TTY: Maine relay 711 Private Health Insurance Premium Webpage: https://www.maine.gov/dhhs/ofi/applications-forms Phone: 1-800-977-6740 TTY: Maine relay 711 | Website: https://www.mass.gov/masshealth/pa Phone: 1-800-862-4840 TTY: 711 Email: masspremassistance@accenture.com |

| MINNESOTA – Medicaid | MISSOURI – Medicaid |

| Website: https://mn.gov/dhs/people-we-serve/children-and-families/health- care/health-care-programs/programs-and-services/other-insurance.jsp Phone: 1- 800-657-3739 | Website: http://www.dss.mo.gov/mhd/participants/pages/hipp.htm Phone: 573- 751-2005 |

| MONTANA – Medicaid | NEBRASKA – Medicaid |

| Website: http://dphhs.mt.gov/MontanaHealthcarePrograms/HIPP Phone: 1-800- 694-3084 Email: HHSHIPPProgram@mt.gov | Website: http://www.ACCESSNebraska.ne.gov Phone: 1-855-632-7633 Lincoln: 402-473-7000 Omaha: 402-595-1178 |

| NEVADA – Medicaid | NEW HAMPSHIRE – Medicaid |

| Medicaid Website: http://dhcfp.nv.gov Medicaid Phone: 1-800-992-0900 | Website: https://www.dhhs.nh.gov/programs-services/medicaid/health-insurance- premium-program Phone: 603-271-5218 Toll free number for the HIPP program: 1-800-852-3345, ext. 5218 |

| NEW JERSEY – Medicaid and CHIP | NEW YORK – Medicaid |

| Medicaid Website: http://www.state.nj.us/humanservices/ dmahs/clients/medicaid/ Medicaid Phone: 609-631-2392 CHIP Website: http://www.njfamilycare.org/index.html CHIP Phone: 1-800-701-0710 | Website: https://www.health.ny.gov/health_care/medicaid/ Phone: 1-800-541- 2831 |

| NORTH CAROLINA – Medicaid | NORTH DAKOTA – Medicaid |

| Website: https://medicaid.ncdhhs.gov/ Phone: 919-855-4100 | Website: https://www.hhs.nd.gov/healthcare Phone: 1-844-854-4825 |

| OKLAHOMA – Medicaid and CHIP | OREGON – Medicaid |

| Website: http://www.insureoklahoma.org Phone: 1-888-365-3742 | Website: http://healthcare.oregon.gov/Pages/index.aspx Phone: 1-800-699-9075 |

| PENNSYLVANIA – Medicaid and CHIP | RHODE ISLAND – Medicaid and CHIP |

| Website: https://www.dhs.pa.gov/Services/Assistance/Pages/HIPP-Program.aspx Phone: 1-800-692-7462 CHIP Website: Children’s Health Insurance Program (CHIP) (pa.gov) CHIP Phone: 1-800-986-KIDS (5437) | Website: http://www.eohhs.ri.gov/ Phone: 1-855-697-4347, or 401-462-0311 (Direct RIte Share Line) |

| SOUTH CAROLINA – Medicaid | SOUTH DAKOTA – Medicaid |

| Website: https://www.scdhhs.gov Phone: 1-888-549-0820 | Website: http://dss.sd.gov Phone: 1-888-828-0059 |

| TEXAS – Medicaid | UTAH – Medicaid and CHIP |

| Website: Health Insurance Premium Payment (HIPP) Program | Texas Health and Human Services Phone: 1-800-440-0493 | Medicaid Website: https://medicaid.utah.gov/ CHIP Website: http://health.utah.gov/chip Phone: 1-877-543-7669 |

| VERMONT– Medicaid | VIRGINIA – Medicaid and CHIP |

| Website: Health Insurance Premium Payment (HIPP) Program | Department of Vermont Health Access Phone: 1-800-250-8427 | Website: https://coverva.dmas.virginia.gov/learn/premium-assistance/famis- select https://coverva.dmas.virginia.gov/learn/premium-assistance/health- insurance-premium-payment-hipp-programs Medicaid/CHIP Phone: 1-800-432- 5924 |

| WASHINGTON – Medicaid | WEST VIRGINIA – Medicaid and CHIP |

| Website: https://www.hca.wa.gov/ Phone: 1-800-562-3022 | Website: https://dhhr.wv.gov/bms/ http://mywvhipp.com/ Medicaid Phone:304- 558-1700 CHIP Toll-free phone: 1-855-MyWVHIPP (1-855-699-8447) |

| WISCONSIN – Medicaid and CHIP | WYOMING – Medicaid |

| Website: https://www.dhs.wisconsin.gov/badgercareplus/p-10095.htm Phone: 1- 800-362-3002 | Website: https://health.wyo.gov/healthcarefin/medicaid/programs-and-eligibility/ Phone: 1-800-251-1269 |

To see if any other states have added a premium assistance program since July 31, 2023, or for more information on special enrollment rights, contact either:

U.S. Department of Labor

Employee Benefits Security Administration

https://www.dol.gov/agencies/ebsa

1-866-444-EBSA (3272)

U.S. Department of Health and Human Services

Centers for Medicare & Medicaid Services

1-877-267-2323, Menu Option 4, Ext. 61565

If you are declining enrollment for yourself or your dependents (including your spouse) because of other health insurance or group health plan coverage, you may be able to enroll yourself and your dependents in this plan if you or your dependents lose eligibility for that other coverage (or if the employer stops contributing toward your or your dependents’ other coverage). However, you must request enrollment within after your or your dependents’ other coverage ends (or after the employer stops contributing toward the other coverage).

In addition, if you have a new dependent as a result of marriage, birth, adoption, or placement for adoption, you may be able to enroll yourself and your dependents. However, you must request enrollment within after the marriage, birth, adoption, or placement for adoption.

For plans and issuers that require or allow for the designation of primary care providers by participants or beneficiaries, insert:

Aetna Health generally ALLOWS the designation of a primary care provider. You have the right to designate any primary care provider who participates in our network and who is available to accept you or your family members. Until you make this designation, the group health plan designates one for you For information on how to select a primary care provider.

For plans and issuers that require or allow for the designation of a primary care provider for a child, add: For children, you may designate a pediatrician as the primary care provider.

For plans and issuers that provide coverage for obstetric or gynecological care and require the designation by a participant or beneficiary of a primary care provider, add: You do not need prior authorization from Aetna Health or from any other person (including a primary care provider) in order to obtain access to obstetrical or gynecological care from a health care professional in our network who specializes in obstetrics or gynecology. The health care professional, however, may be required to comply with certain procedures, including obtaining prior authorization for certain services, following a pre-approved treatment plan, or procedures for making referrals.

Group health plans and health insurance issuers generally may not, under Federal law, restrict benefits for any hospital length of stay in connection with childbirth for the mother or newborn child to less than 48 hours following a vaginal delivery, or less than 96 hours following a cesarean section. However, Federal law generally does not prohibit the mother’s or newborn’s attending provider, after consulting with the mother, from discharging the mother or her newborn earlier than 48 hours (or 96 hours as applicable). In any case, plans and issuers may not, under Federal law, require that a provider obtain authorization from the plan or the insurance issuer for prescribing a length of stay not in excess of 48 hours (or 96 hours).

If you have had or are going to have a mastectomy, you may be entitled to certain benefits under the Women’s Health and Cancer Rights Act of 1998 (WHCRA). For individuals receiving mastectomy-related benefits, coverage will be provided in a manner determined in consultation with the attending physician and the patient, for:

All stages of reconstruction of the breast on which the mastectomy was performed; Surgery and reconstruction of the other breast to produce a Symmetrical appearance Prostheses; and

Treatment of physical complications of the mastectomy, including lymphedema.

These benefits will be provided subject to the same deductibles and coinsurance applicable to other medical and surgical benefits provided under this plan. Therefore, the following deductibles and coinsurance apply: See plan benefit highlight sheets.

Do you know that your plan, as required by the Women’s Health and Cancer Rights Act of 1998, provides benefits for mastectomy-related services including all stages of reconstruction and surgery to achieve symmetry between the breasts, prostheses, and complications resulting from a mastectomy, including lymphedema? Call your plan administrator at ………………. for more information.

(For use by single-employer group health plans)

** Continuation Coverage Rights Under COBRA**

You’re getting this notice because you recently gained coverage under a group health plan (the Plan). This notice has important information about your right to COBRA continuation coverage, which is a temporary extension of coverage under the Plan. This notice explains COBRA continuation coverage, when it may become available to you and your family, and what you need to do to protect your right to get it. When you become eligible for COBRA, you may also become eligible for other coverage options that may cost less than COBRA continuation coverage.

The right to COBRA continuation coverage was created by a federal law, the Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA). COBRA continuation coverage can become available to you and other members of your family when group health coverage would otherwise end. For more information about your rights and obligations under the Plan and under federal law, you should review the Plan’s Summary Plan Description or contact the Plan Administrator.

You may have other options available to you when you lose group health coverage. For example, you may be eligible to buy an individual plan through the Health Insurance Marketplace. By enrolling in coverage through the Marketplace, you may qualify for lower costs on your monthly premiums and lower out-of- pocket costs. Additionally, you may qualify for a 30-day special enrollment period for another group health plan for which you are eligible (such as a spouse’s plan), even if that plan generally doesn’t accept late enrollees.

COBRA continuation coverage is a continuation of Plan coverage when it would otherwise end because of a life event. This is also called a “qualifying event.” Specific qualifying events are listed later in this notice. After a qualifying event, COBRA continuation coverage must be offered to each person who is a “qualified beneficiary.” You, your spouse, and your dependent children could become qualified beneficiaries if coverage under the Plan is lost because of the qualifying event. Under the Plan, qualified beneficiaries who elect COBRA continuation coverage MUST PAY for COBRA continuation coverage.

If you’re an employee, you’ll become a qualified beneficiary if you lose your coverage under the Plan because of the following qualifying events:

If you’re the spouse of an employee, you’ll become a qualified beneficiary if you lose your coverage under the Plan because of the following qualifying events:

Your dependent children will become qualified beneficiaries if they lose coverage under the Plan because of the following qualifying events:

Sometimes, filing a proceeding in bankruptcy under title 11 of the United States Code can be a qualifying event. If a proceeding in bankruptcy is filed with respect to Your Company, and that bankruptcy results in the loss of coverage of any retired employee covered under the Plan, the retired employee will become a qualified beneficiary. The retired employee’s spouse, surviving spouse, and dependent children will also become qualified beneficiaries if bankruptcy results in the loss of their coverage under the Plan.

The Plan will offer COBRA continuation coverage to qualified beneficiaries only after the Plan Administrator has been notified that a qualifying event has occurred. The employer must notify the Plan Administrator of the following qualifying events:

For all other qualifying events (divorce or legal separation of the employee and spouse or a dependent child’s losing eligibility for coverage as a dependent child), you must notify the Plan Administrator within 60 after the qualifying event occurs. You must provide this notice to: Your Company.

Once the Plan Administrator receives notice that a qualifying event has occurred, COBRA continuation coverage will be offered to each of the qualified

beneficiaries. Each qualified beneficiary will have an independent right to elect COBRA continuation coverage. Covered employees may elect COBRA continuation coverage on behalf of their spouses, and parents may elect COBRA continuation coverage on behalf of their children.

COBRA continuation coverage is a temporary continuation of coverage that generally lasts for 18 months due to employment termination or reduction of hours of work. Certain qualifying events, or a second qualifying event during the initial period of coverage, may permit a beneficiary to receive a maximum of 36 months of coverage.

There are also ways in which this 18-month period of COBRA continuation coverage can be extended:

Disability extension of 18-month period of COBRA continuation coverage

If you or anyone in your family covered under the Plan is determined by Social Security to be disabled and you notify the Plan Administrator in a timely fashion, you and your entire family may be entitled to get up to an additional 11 months of COBRA continuation coverage, for a maximum of 29 months. The disability would have to have started at some time before the 60th day of COBRA continuation coverage and must last at least until the end of the 18-month period of COBRA continuation coverage.

Second qualifying event extension of 18-month period of continuation coverage

If your family experiences another qualifying event during the 18 months of COBRA continuation coverage, the spouse and dependent children in your family can get up to 18 additional months of COBRA continuation coverage, for a maximum of 36 months, if the Plan is properly notified about the second qualifying event. This extension may be available to the spouse and any dependent children getting COBRA continuation coverage if the employee or former employee dies; becomes entitled to Medicare benefits (under Part A, Part B, or both); gets divorced or legally separated; or if the dependent child stops being eligible under the Plan as a dependent child. This extension is only available if the second qualifying event would have caused the spouse or dependent child to lose coverage under the Plan had the first qualifying event not occurred.

Yes. Instead of enrolling in COBRA continuation coverage, there may be other coverage options for you and your family through the Health Insurance Marketplace, Medicaid, Children’s Health Insurance Program (CHIP), or other group health plan coverage options (such as a spouse’s plan) through what is called a “special enrollment period.” Some of these options may cost less than COBRA continuation coverage. You can learn more about many of these options at www.healthcare.gov.

In general, if you don’t enroll in Medicare Part A or B when you are first eligible because you are still employed, after the Medicare initial enrollment period, you have an 8-month special enrollment period* to sign up for Medicare Part A or B, beginning on the earlier of

If you don’t enroll in Medicare and elect COBRA continuation coverage instead, you may have to pay a Part B late enrollment penalty and you may have a gap in coverage if you decide you want Part B later. If you elect COBRA continuation coverage and later enroll in Medicare Part A or B before the COBRA continuation coverage ends, the Plan may terminate your continuation coverage. However, if Medicare Part A or B is effective on or before the date of the COBRA election, COBRA coverage may not be discontinued on account of Medicare entitlement, even if you enroll in the other part of Medicare after the date of the election of COBRA coverage.

If you are enrolled in both COBRA continuation coverage and Medicare, Medicare will generally pay first (primary payer) and COBRA continuation coverage will pay second. Certain plans may pay as if secondary to Medicare, even if you are not enrolled in Medicare.

For more information visit https://www.medicare.gov/medicare-and-you.

* https://www.medicare.gov/basics/get-started-with-medicare/sign-up/when-does-medicare-coverage-start.

Questions concerning your Plan or your COBRA continuation coverage rights should be addressed to the contact or contacts identified below. For more information about your rights under the Employee Retirement Income Security Act (ERISA), including COBRA, the Patient Protection and Affordable Care Act, and other laws affecting group health plans, contact the nearest Regional or District Office of the U.S. Department of Labor’s Employee Benefits Security Administration (EBSA) in your area or visit www.dol.gov/ebsa. (Addresses and phone numbers of Regional and District EBSA Offices are available through EBSA’s website.) For more information about the Marketplace, visit www.HealthCare.gov.

To protect your family’s rights, let the Plan Administrator know about any changes in the addresses of family members.You should also keep a copy, for your records, of any notices you send to the Plan Administrator.

When key parts of the health care law take effect in 2014, there will be a new way to buy health insurance: the Health Insurance Marketplace. To assist you as you evaluate options for you and your family, this notice provides some basic information about the new Marketplace and employment-based health coverage offered by your employer.

The Marketplace is designed to help you find health insurance that meets your needs and fits your budget. The Marketplace offers “one-stop shopping” to find and compare private health insurance options. You may also be eligible for a new kind of tax credit that lowers your monthly premium right away. Open enrollment for health insurance coverage through the Marketplace begins in October 2013 for coverage starting as early as January 1, 2014.

You may qualify to save money and lower your monthly premium, but only if your employer does not offer coverage, or offers coverage that doesn’t meet certain standards. The savings on your premium that you’re eligible for depends on your household income.

Yes. If you have an offer of health coverage from your employer that meets certain standards, you will not be eligible for a tax credit through the Marketplace and may wish to enroll in your employer’s health plan. However, you may be eligible for a tax credit that lowers your monthly premium, or a reduction in certain cost- sharing if your employer does not offer coverage to you at all or does not offer coverage that meets certain standards. If the cost of a plan from your employer that would cover you (and not any other members of your family) is more than 9.5% of your household income for the year, or if the coverage your employer provides does not meet the “minimum value” standard set by the Affordable Care Act, you may be eligible for a tax credit. *An employer-sponsored health plan meets the “minimum value standard” if the plan’s share of the total allowed benefit costs covered by the plan is no less than 60 percent of such costs.

Note: If you purchase a health plan through the Marketplace instead of accepting health coverage offered by your employer, then you may lose the employer contribution (if any) to the employer-offered coverage. Also, this employer contribution -as well as your employee contribution to employer-offered coverage- is often excluded from income for Federal and State income tax purposes. Your payments for coverage through the Marketplace are made on an after-tax basis.

For more information about your coverage offered by your employer, please check your summary plan description or contact your employer via the information provided below.

The Marketplace can help you evaluate your coverage options, including your eligibility for coverage through the Marketplace and its cost. Please visit HealthCare.gov for more information, including an online application for health insurance coverage and contact information for a Health Insurance Marketplace in your area.

This section contains information about any health coverage offered by your employer. If you decide to complete an application for coverage in the Marketplace, you will be asked to provide this information. This information is numbered to correspond to the Marketplace application.

3. Employer Name Your Company | 4. Employer identification Number (EIN) ……………….. | |

5. Employer Address 550 Pinetown Rd Ste 208 | 6. Employer Phone Number …………………. | |

7. City Fort Washington | 8. State PA | 9. Zip Code …………… |

| 10. Who can we contact about employee health coverage at this job? | ||

Here is some basic information about health coverage offered by this employer

![]() All Employees, Eligible employees are:

All Employees, Eligible employees are:

![]() Some Employees, Eligible employees are:

Some Employees, Eligible employees are:

![]() We do offer coverage, Eligible dependents are:

We do offer coverage, Eligible dependents are:

![]() We do not offer coverage.

We do not offer coverage.

![]() If checked, this coverage meets the minimum value standard, and the cost of this coverage to you is intended to be affordable, based on employee wages.

If checked, this coverage meets the minimum value standard, and the cost of this coverage to you is intended to be affordable, based on employee wages.

** Even if your employer intends your coverage to be affordable, you may still be eligible for a premium discount through the Marketplace. The Marketplace will use your household income, along with other factors, to determine whether you may be eligible for a premium discount. If, for example, your wages vary from week to week (perhaps you are an hourly employee or you work on a commission basis), if you are newly employed mid-year, or if you have other income losses, you may still qualify for a premium discount.

If you decide to shop for coverage in the Marketplace, HealthCare.gov will guide you through the process. Here’s the employer information you’ll enter when you visit HealthCare.gov to find out if you can get a tax credit to lower your monthly premiums.

The information below corresponds to the Marketplace Employer Coverage Tool. Completing this section is optional for employers, but will help ensure employees understand their coverage choices.

13. Is the employee currently eligible for coverage offered by this employer, or will the employee be eligible in the next 3 months?

![]() Yes (Continue)

Yes (Continue)

13a. If the employee is not eligible today, including as a result of a waiting or probationary period, when is the employee eligible for coverage?

(mm/dd/yyyy) (Continue)

![]() No (STOP and return this form to employee)

No (STOP and return this form to employee)

14. Does the employer offer a health plan that meets the minimum value standard*?

![]() Yes (Go to question 15)

Yes (Go to question 15) ![]() No (STOP and return form to employee)

No (STOP and return form to employee)

a. For the lowest-cost plan that meets the minimum value standard* offered only to the employee (don’t include family plans): If the employer has wellness programs, provide the premium that the employee would pay if he/ she received the maximum discount for any tobacco cessation programs, and didn’t receive any other discounts based on wellness programs.

b. How much would the employee have to pay in premiums for this plan?

c. How often ? ![]() Weekly

Weekly ![]() Every 2 weeks

Every 2 weeks ![]() Twice a Month

Twice a Month ![]() Monthly

Monthly ![]() Quarterly

Quarterly ![]() Yearly

Yearly

If the plan year will end soon and you know that the health plans offered will change, go to question 16. If you don’t know, STOP and return form to employee.

15. What change will the employer make for the new plan year?

![]() Employer won’t offer health coverage

Employer won’t offer health coverage

![]() Employer will start offering health coverage to employees or change the premium for the lowest-cost plan available only to the employee that meets the minimum value standard.* (Premium should reflect the discount for wellness programs. See question 15.)

Employer will start offering health coverage to employees or change the premium for the lowest-cost plan available only to the employee that meets the minimum value standard.* (Premium should reflect the discount for wellness programs. See question 15.)

a. How much would the employee have to pay in premiums for this plan? $

b. How often ? ![]() Weekly

Weekly ![]() Every 2 weeks

Every 2 weeks ![]() Twice a Month

Twice a Month ![]() Monthly

Monthly ![]() Quarterly

Quarterly ![]() Yearly

Yearly

*An employer-sponsored health plan meets the “minimum value standard” if the plan’s share of the total allowed benefit costs covered by the plan is no less than 60 percent of such costs.

Please read this notice carefully and keep it where you can find it. This notice has information about your current prescription drug coverage with Your Company and about your options under Medicare’s prescription drug coverage. This information can help you decide whether or not you want to join a Medicare drug plan. If you are considering joining, you should compare your current coverage, including which drugs are covered at what cost, with the coverage and costs of the plans offering Medicare prescription drug coverage in your area. Information about where you can get help to make decisions about your prescription drug coverage is at the end of this notice.

There are two important things you need to know about your current coverage and Medicare’s prescription drug coverage:

You can join a Medicare drug plan when you first become eligible for Medicare and each year from October 15th to December 7th.

However, if you lose your current creditable prescription drug coverage, through no fault of your own, you will also be eligible for a two (2) month Special Enrollment Period (SEP) to join a Medicare drug plan.

If you decide to join a Medicare drug plan, your current Your Company coverage WILL be affected. .

If you do decide to join a Medicare drug plan and drop your current Your Company coverage, be aware that you and your dependents WILL be able to get this coverage back.

You should also know that if you drop or lose your current coverage with Your Company and don’t join a Medicare drug plan within 63 continuous days after your current coverage ends, you may pay a higher premium (a penalty) to join a Medicare drug plan later.

If you go 63 continuous days or longer without creditable prescription drug coverage, your monthly premium may go up by at least 1% of the Medicare base beneficiary premium per month for every month that you did not have that coverage. For example, if you go nineteen months without creditable coverage, your premium may consistently be at least 19% higher than the Medicare base beneficiary premium. You may have to pay this higher premium (a penalty) as long as you have Medicare prescription drug coverage. In addition, you may have to wait until the following October to join.

Contact the person listed below for further information. NOTE: You’ll get this notice each year. You will also get it before the next period you can join a Medicare drug plan, and if this coverage through Your Company changes. You also may request a copy of this notice at any time.

More detailed information about Medicare plans that offer prescription drug coverage is in the “Medicare & You” handbook. You’ll get a copy of the handbook in the mail every year from Medicare. You may also be contacted directly by Medicare drug plans.

For more information about Medicare prescription drug coverage:

Visit www.medicare.gov

Call your State Health Insurance Assistance Program (see the inside back cover of your copy of the “Medicare & You” handbook for their telephone number) for personalized help

Call 1-800-MEDICARE (1-800-633-4227). TTY users should call1-877-486-2048.

If you have limited income and resources, extra help paying for Medicare prescription drug coverage is available. For information about this extra help, visit Social Security on the web at www.socialsecurity.gov, or call them at 1-800-772-1213 (TTY 1-800-325-0778).

Remember: Keep this Creditable Coverage notice. If you decide to join one of the Medicare drug plans, you may be required to provide a copy of this notice when you join to show whether or not you have maintained creditable coverage and, therefore, whether or not you are required to pay a higher premium (a penalty).

Date:

Contact–Position/Office: ………………….

Address: …………………………..

Name of Entity/Sender:Your Company

Phone Number: ………………

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is …………….. The time required to complete this information collection is estimated to average 8 hours per response initially, including the time to review instructions, search existing data resources, gather the data needed, and complete and review the information collection. If you have comments concerning the accuracy of the time estimate(s) or suggestions for improving this form, please write to: CMS, 7500 Security Boulevard, Attn: PRA Reports Clearance Officer, Mail Stop C4-26-05, Baltimore, Maryland 21244-1850.

The Families First Coronavirus Response Act (FFCRA or Act) requires certain employers to provide their employees with paid sick leave and expanded family and medical leave for specified reasons related to COVID-19. These provisions will apply from April 1, 2020 through December 31, 2020.

Generally, employers covered under the Act must provide employees:

Up to two weeks (80 hours, or a part-time employee’s two-week equivalent) of paid sick leave based on the higher of their regular rate of pay, or the applicable state or Federal minimum wage, paid at:

100% for qualifying reasons #1-3 below, up to $511 daily and $5,110 total;

2/3 for qualifying reasons #4 and 6 below, up to $200 daily and $2,000 total; and

Up to 12 weeks of paid sick leave and expanded family and medical leave paid at 2/3 for qualifying reason #5 below for up to $200 daily and $12,000 total.

A part-time employee is eligible for leave for the number of hours that the employee is normally scheduled to work over that period.

In general, employees of private sector employers with fewer than 500 employees, and certain public sector employers, are eligible for up to two weeks of fully or partially paid sick leave for COVID-19 related reasons (see below). Employees who have been employed for at least 30 days prior to their leave request may be eligible for up to an additional 10 weeks of partially paid expanded family and medical leave for reason #5 below.

An employee is entitled to take leave related to COVID-19 if the employee is unable to work, including unable to telework, because the employee:

The U.S. Department of Labor’s Wage and Hour Division (WHD) has the authority to investigate and enforce compliance with the FFCRA. Employers may not discharge, discipline, or otherwise discriminate against any employee who lawfully takes paid sick leave or expanded family and medical leave under the FFCRA, files a complaint, or institutes a proceeding under or related to this Act. Employers in violation of the provisions of the FFCRA will be subject to penalties and enforcement by WHD.

For additional information or to file a complaint: 1-866-487-9243

TTY: 1-877-889-5627

dol.gov/agencies/whd

Your Information. Your Rights. Our Responsibilities.

This notice describes how medical information about you may be used and disclosed and how you can get access to this information. Please review it carefully.

You have the right to:

Get a copy of your health and claims records Correct your health and claims records

Request confidential communication

Ask us to limit the information we share

Get a list of those with whom we’ve shared your information Get a copy of this privacy notice

Choose someone to act for you

File a complaint if you believe your privacy rights have been violated

You have some choices in the way that we use and share information as we:

Answer coverage questions from your family and friends Provide disaster relief

Market our services and sell your information

We may use and share your information as we:

Help manage the health care treatment you receive Run our organization

Pay for your health services Administer your health plan

Help with public health and safety issues Do research

Comply with the law

Respond to organ and tissue donation requests and work with a medical examiner or funeral director Address workers’ compensation, law enforcement, and other government requests

Respond to lawsuits and legal actions

When it comes to your health information, you have certain rights. This section explains your rights and some of our responsibilities to help you.

You can ask to see or get a copy of your health and claims records and other health information we have about you. Ask us how to do this.

We will provide a copy or a summary of your health and claims records, usually within 30 days of your request. We may charge a reasonable, cost-based fee.

You can ask us to correct your health and claims records if you think they are incorrect or incomplete. Ask us how to do this. We may say “no” to your request, but we’ll tell you why in writing within 60 days.

You can ask us to contact you in a specific way (for example, home or office phone) or to send mail to a different address. We will consider all reasonable requests, and must say “yes” if you tell us you would be in danger if we do not.

You can ask us not to use or share certain health information for treatment, payment, or our operations. We are not required to agree to your request, and we may say “no” if it would affect your care.

You can ask for a paper copy of this notice at any time, even if you have agreed to receive the notice electronically. We will provide you with a paper copy promptly.

For certain health information, you can tell us your choices about what we share. If you have a clear preference for how we share your information in the situations described below, talk to us. Tell us what you want us to do, and we will follow your instructions.

In these cases, you have both the right and choice to tell us to:

If you are not able to tell us your preference, for example if you are unconscious, we may go ahead and share your information if we believe it is in your best interest. We may also share your information when needed to lessen a serious and imminent threat to health or safety.

In these cases we never share your information unless you give us written permission:

How do we typically use or share your health information?

We typically use or share your health information in the following ways.

Help manage the health care treatment you receive

Run our organization

Example: We use health information about you to develop better services for you.

Pay for your health services

Administer your plan

How else can we use or share your health information?

We are allowed or required to share your information in other ways – usually in ways that contribute to the public good, such as public health and research. We have to meet many conditions in the law before we can share your information for these purposes. For more information see:

www.hhs.gov/ocr/privacy/hipaa/understanding/consumers/index.html

Special Notes: We never sell or market your personal information

Greater limits on disclosures: We will never share any substance abuse treatment records without your written permission.

We can share health information about you for certain situations such as:

We can use or share your information for health research.

We will share information about you if state or federal laws require it, including with the Department of Health and Human Services if it wants to see that we’re complying with federal privacy law.

We can use or share health information about you:

We can share health information about you in response to a court or administrative order, or in response to a subpoena.

For more information see: www.hhs.gov/ocr/privacy/hipaa/understanding/consumers/noticepp.html

We can change the terms of this notice, and the changes will apply to all information we have about you. The new notice will be available upon request, on our web site, and we will mail a copy to you.

Effective Date of this notice:2024-01-01

OHCA notice:

Privacy Official………………

The Genetic Information Nondiscrimination Act of 2008 (GINA) prohibits discrimination in group health plan coverage based on genetic information.

Builds on HIPAA’s protections. GINA expands the genetic information protections included in the Health Insurance Portability and Accountability Act of 1996 (HIPAA). Before the Affordable Care Act, HIPAA prevented a plan or issuer from imposing a preexisting condition exclusion based solely on genetic information. Under the Affordable Care Act, plans are prohibited from excluding coverage or benefits due to any preexisting condition. HIPAA continues to prohibit discrimination in eligibility, benefits, or premiums based on a health factor (including genetic information).

Additional underwriting protections. GINA provides that group health plans cannot adjust premiums or contribution amounts for a plan, or a group of similarly situated individuals under the plan, based on genetic information of one or more individuals in the group. (However, premiums may be increased for the group based upon the manifestation of a disease or disorder of an individual enrolled in the plan.)

Prohibits requiring genetic testing. GINA generally prohibits plans and issuers from requesting or requiring an individual to undergo a genetic test. However, a health care professional providing health care services to an individual is permitted to request a genetic test. A plan or issuer may request the results of a genetic test to determine payment of a claim for benefits, but only the minimum amount of information necessary in order to determine payment. There is also a research exception that permits a plan or issuer under certain conditions to request (but not require) that a participant or beneficiary undergo a genetic test.

Restricts collection of genetic information. GINA prohibits plans from collecting genetic information (including family medical history) from an individual prior to or in connection with enrollment in the plan, or at any time for underwriting purposes. Thus, under GINA, plans and issuers are generally prohibited from offering rewards in return for the provision of genetic information, including family medical history information collected as part of a Health Risk Assessment (HRA).

GINA includes an exception for incidental collection of genetic information, provided the information is not used for underwriting purposes. However, the GINA regulations make clear that the incidental collection exception is not available if it is reasonable for the plan or issuer to anticipate that health information will be received in response to a collection, unless the collection explicitly states that genetic information should not be provided.

Other protections. GINA also contains individual insurance market provisions, administered by the Department of Health and Human Services’ Centers for Medicare & Medicaid Services, privacy and confidentiality provisions, administered by the Department of Health and Human Services’ Office for Civil Rights, and employment-related provisions, administered by the Equal Employment Opportunity Commission (EEOC).

For more information, see the Frequently Asked Questions Regarding the Genetic Information Nondiscrimination Act on the EBSA Website.

Do you know that your plan, as required by the Women’s Health and Cancer Rights Act of 1998, provides benefits for mastectomy-related services including all stages of reconstruction and surgery to achieve symmetry between the breasts, prostheses, and complications resulting from a mastectomy, including lymphedema? Call your plan administrator at ……………… for more information.

Note: Pursuant to Michelle’s Law, you are being provided with the following notice because the Your Company group health plan provides dependent coverage beyond age 26 and bases eligibility for such dependent coverage on student status. Please review the following information with respect to your dependent child’s rights under the plan in the event student status is lost.

When a dependent child loses student status for purposes of Your Company group health plan coverage as a result of a medically necessary leave of absence from a post-secondary educational institution, the Your Company group health plan will continue to provide coverage during the leave of absence for up to one year, or until coverage would otherwise terminate under the Your Company group health plan, whichever is earlier.

In order to be eligible to continue coverage as a dependent during such leave of absence:

To obtain additional information, please contact: …………, Director – HR and Benefits, ……………………..